The modern platform for growing investment managers

Limina's investment management software helps everyone on your team from portfolio managers to investment operations save valuable time with smooth workflows & smart automation.

Trusted by asset managers, asset owners and hedge funds with $100mn - $30bn AUM

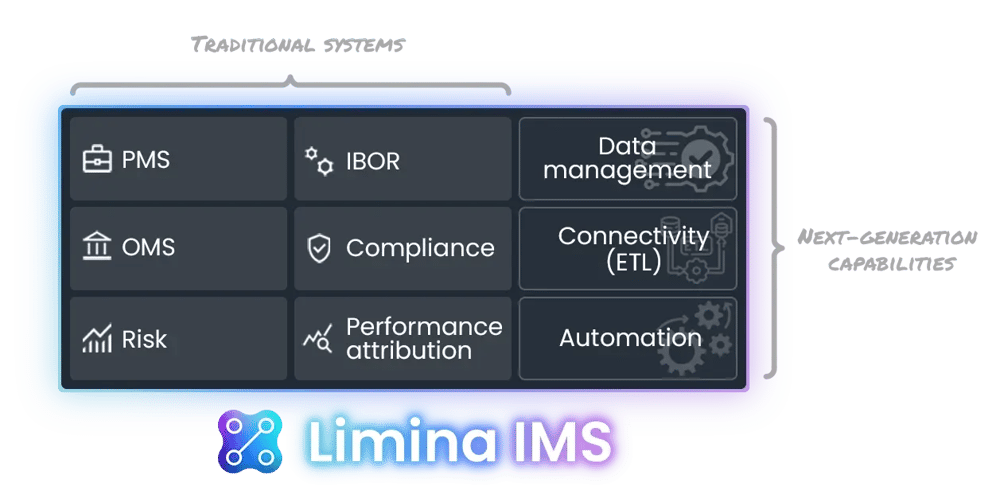

All your investment workflows in one place

Limina's Investment Management Solution (IMS) combines the workflows you need with powerful data & automation capabilities - all in one solution.

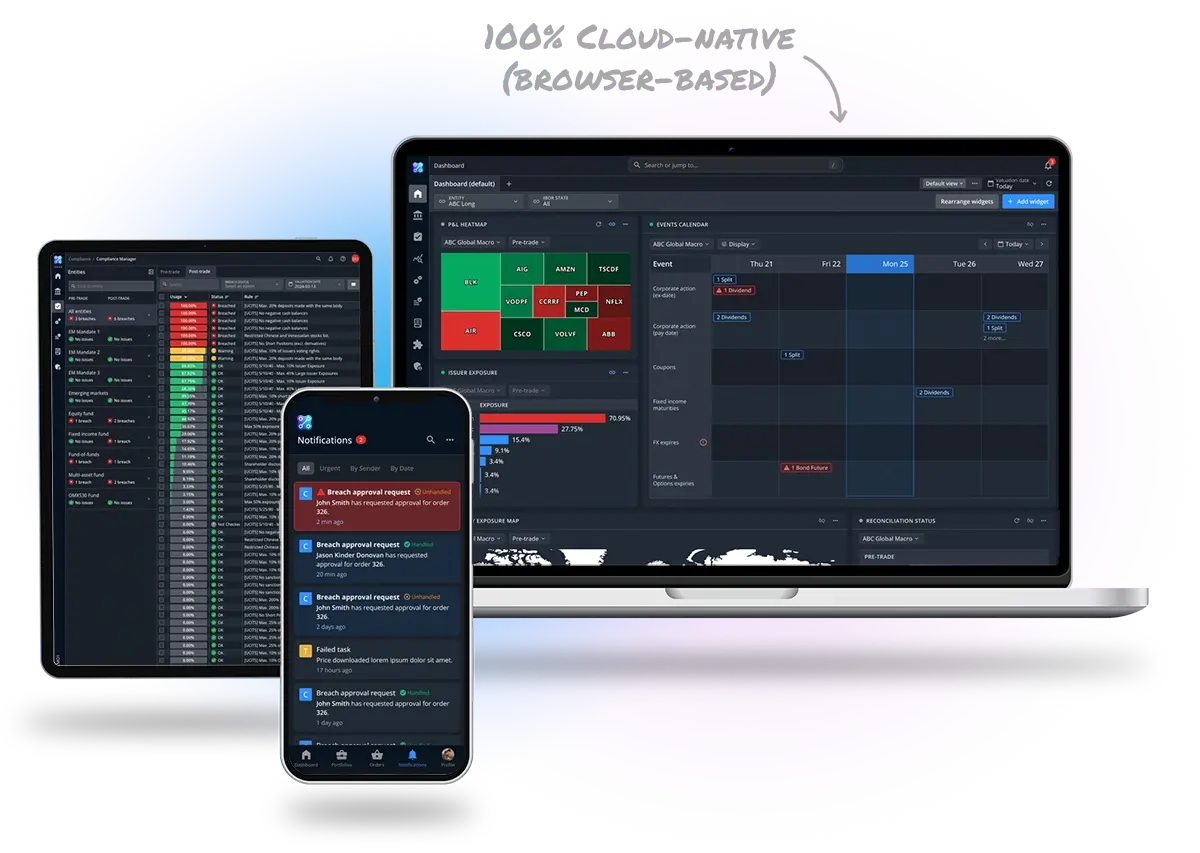

Spend less time on your daily investment management workflows

Smooth workflows and strong automation capabilities help you get your work done quickly. From anywhere.

BEFORE LIMINA

Manual processes

Unsure if you can trust the data

Key person risk

Difficult to scale

WITH LIMINA

High automation level

Single source of truth - quality controlled

Full oversight

Highly scalable

“The move to Limina has been transformative for front office and investment operations. We’ve eliminated routine work - enabled by exception-based workflows.”

Explore Limina IMS

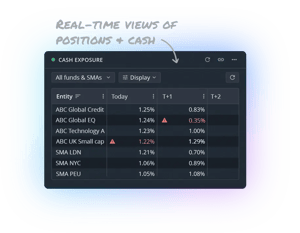

Monitor, analyze and calibrate your portfolios with ease

- Flexible dashboard & portfolio views with 300+ measures, look-through and benchmark comparison

- Smooth order raising & rebalance workflows for one or multiple portfolios at once

- Powerful simulation capabilities incl. effect on positions, cash and compliance - today and forward-looking

Read more:

Portfolio management

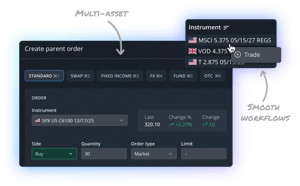

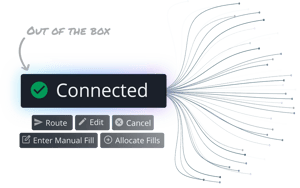

Efficiently create & manage orders through their lifecycle

- Smooth order raising workflows for a wide range of investment styles (multi-asset)

- Out-of-the-box connectivity to brokers, outsourced trading desks and EMS's

- Multi-portfolio support incl. allocation workflows for block orders

Read more:

Order management

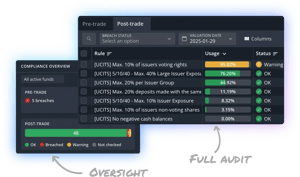

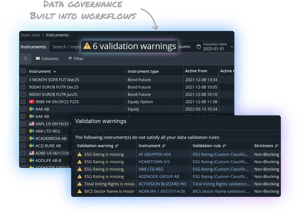

Compliance and risk analysis - embedded into your workflows

- Seamless pre-trade, intraday and post-trade compliance checks, with full audit

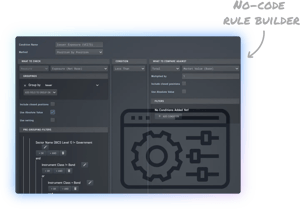

- Supports "any" type of limits and restrictions with our no-code rule builder

- Comprehensive risk analysis incl. exposures, sensitivities, VaR, scenarios & stress tests

Read more:

Investment compliance

Risk management

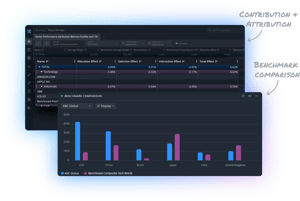

Analyze portfolio returns vs benchmark

- Analyze returns across any segment (sector, geography etc.)

- Market standard attribution models (Brinson-Fachler)

- No approximations - transaction-based & daily TWR, based on the complete & reconciled portfolio data

Read more:

Performance attribution

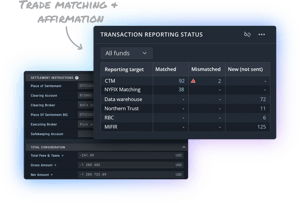

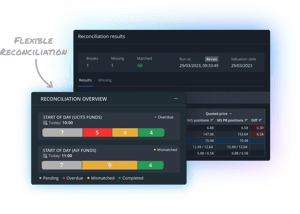

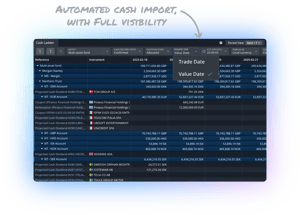

Operate with full oversight and exception-based workflows

- Trade matching & affirmation

- Reconciliation & shadow NAV

- Cash management, corporate actions & position lifecycle

- Operations Hub where you can keep track of any recurring processes

Read more:

Investment operations

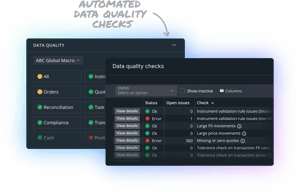

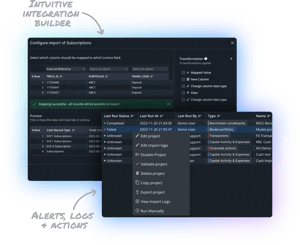

Automate data governance and import & export workflows

- Automated data quality controls

- Extensible data models lets you enrich your security master & portfolio data with any custom data

- Strong connectivity - incl. ability to build your own integrations with our no-code ETL application

- Custom report builder

Read more:

Data management

Reporting

“It’s such a modern portfolio management system – not only because it’s cloud-based, but the entire process flow and information I get is complete and up to date. It’s simple to use, flexible to work with, and it minimises the time for the entire trade workflow.”

See how Limina can help!

Want to see how we can help you save valuable time in your daily investment management workflows?

Why companies are switching to Limina

Want to learn more?

Regardless of where you are in your journey toward a new investment solution, we have plenty of useful resources that are sure to help:

-

Just browsing

-

Learning about the alternatives

-

Learning about Limina

Sign up for a free 30min intro session with our CEO & founder!

Read More

Use our free resource to ask better questions to the vendors you are evaluating.

Read More

It's a jungle out there. Our guide helps you navigate it!

Read More

Free collection of thoughtful and actionable advice when selecting investment software.

Read More

Learn more about Limina's investment management software.

Read More

Check to see if Limina IMS is the right system for you.

Read More

Check when we might not be the best fit for you.

Read MoreNot all investment firms are the same. Find out if Limina fits yours.

Whether you’re an asset manager, asset owner, hedge fund, ETF provider or wealth manager, Limina supports a wide range of investment firm types with tools that handle funds and SMAs, public or private investments, multi-asset strategies, sophisticated compliance and data automation.