Alternative Investment Management Software: Features & Benefits

What is alternative investment software?

First of all, what type of alternative investment management software are you considering? Is it an investment management platform - with position and cash management at the core, or is it a simple deal management platform?

In this article, we focus on the former: a system capable of helping you track and plan your existing investments together with planned new ones.

For full disclosure, Limina offers such software. We’re all about transparency; you can read about when we’re a great fit and when we might not be the best choice. We also publish our price list online.

Capabilities of the best alternative investment technology

We start by exploring 4 capabilities that aren’t available in all alternative investment management software. These capabilities are relevant if you invest in alternative assets, including private equity, venture capital, real estate, infrastructure, etc.

1. Plan cash and exposure in time and with likelihood

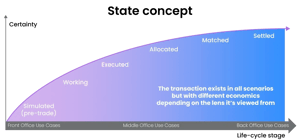

All investments and cashflows go through a path towards certainty. For example, an investment might first be hypothetical, then we’re leaning into it, then we’ve reviewed terms, and then we’ve signed. And eventually cash will move as a consequence.

With a flick of a button, Limina IMS is uniquely able to show your portfolio and cash (today and future) with or without transactions of specified certainty levels (“states”).

Most systems can show cash date by date (committed vs settled), including fees, FX, etc. Only the best systems can show future deal dates, i.e. the portfolio at future dates, for a trade we’re evaluating. That considers planning, for example, a redemption and not executing it until the last possible date to match cash and keep flexibility.

2. Data connectivity, e.g. ingestion of general partner reports

Existing providers rely on managed integrations to get data into the system from general partners, custodians, benchmarks, etc. Each integration is coded and maintained by the vendor. The downsides with this approach are:

- It takes weeks or months to add a new data source (e.g., a new GP)

- It costs you money, e.g. pay per report to the vendor

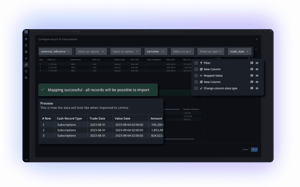

There is a new way to make the process of data aggregation faster and cheaper: a user-configurable import application. The benefits are:

- You’re not dependent on us as a vendor to have an integration built

- Build new import for anything (holdings, capital calls, cash, etc) in minutes

- Get warnings on data issues or delays

- Precise and predictable processing - no machine learning or AI that you can’t trust

- Free of charge

Limina is a pioneer and, to our knowledge, the only limited partner software with a built-in user-configurable data import/export application – and it’s free of charge! You can also use it standalone without our platform. Please contact us to get free access.

The application also functions as a reporting software, i.e., it can export data from the system. Read more about reporting capabilities below.

3. Look-through

Look-through enables exposure views to be sliced on sector, region, etc. Performance calculations are also enabled; for example, Brinson-Fachler that shows performance effects of all your Private Equity (PE) and Venture Capital (VC) investments in aggregate.

Look-through can be possible at both the constituent and proxy levels (e.g., “20% industrials”). Some systems support both (such as Limina). Curious to learn how it works? Get a no-strings-attached demo of Limina’s ESG capabilities.

We have a dedicated article about fund-of-funds software if you want to dig deeper.

4. Tracking of ESG considerations

Many alternative investment managers:

- Have ESG (Environmental, Social, Governance) driven holding rules (limits and restrictions)

- Report ESG data on their portfolios

- Perform analysis and comparisons based on ESG considerations

- Consider ESG when planning portfolio composition

Beyond look-through, ESG data consolidation of PE/VC-funds or direct private investments is challenging because private companies don’t report ESG data in the same way as public companies do. A flexible alternative investment fund management software can import proxy data based on firmographics. In other words, for each holding company of a PE/VC-firm, map out what public companies are similar to those companies and approximate the ESG data based on that comparison.

Explore smoother workflows

See how Limina’s system can help you spend less time on daily workflows.

Get all portfolio data – validated – at your fingertips.

Other functions of alternative investment technology

Ability to represent all cash movements, including those not generated from trading activity, such as fees, taxes, consultancy costs, etc.

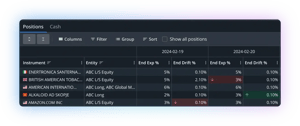

From there, being able to show the portfolio and cash per any date: historical, current, future) and strike a NAV (if nothing else, for duality control purposes).

An essential capability of investment technology is its ability to perform reconciliations. We see reconciliations performed in the following order:

- Transactions (incl. tax, commissions).

- Lifecycle event (corporate actions, capital calls, etc).

- Positions/holdings.

- Cash balances (here, anything that affects cash is caught).

Note: some managers stop here - P&L (accruals, other taxes, etc, caught here).

Optional - NAV.

Optional

Limina’s state concept (explained at the beginning of this article) makes reconciliation against counterparties straightforward, because adjustments are never needed. The reconciliation engine is completely exception-based, which means you’ll get alerted on delayed recons, missing data, etc – and if everything goes according to plan, it’s entirely hands-off. Book a demo to see it yourself.

Alternative investment software solutions will calculate indicators and ratios across your portfolios such as TWWR, IRR, multiples, modified dietz, quartile rankings, benchmark returns, performance (attribution) and risk measures.

With the analytics at hand, some systems allow you to compare your portfolio(s) relative to your policy targets.

The best alternative investment software has a user-configurable import/export application (discussed above). That application is well-suited for non-standardised data such as reports from general partners or custodians.

For standardised data sources, managed integrations are preferred. For example, connectivity to market data via your data vendor of choice or legal entity data via GLEIF.

An audit trail of allocation decisions is a core capability of alternative investment technology solutions.

Some systems also can perform limit checks and apply restrictions. Examples include concentration limits and restricted industries. Sometimes, this type of functionality is referred to as investment compliance software.

Running data controls is often only done manually for high-prioritised data or not at all. However, with the right alternative investment technology, you can let the system perform data quality checks.

Examples include instrument parameters (even for look-through holdings), GP valuation outliers, legal entity information, etc. Check out how Limina can perform data checks so you can be confident in what you see without spending valuable resources on manual checks.

Discover what reporting capabilities Limina’s limited partner reporting software module has.

Exception-based workflows

Exception-based workflow processes are an alternative to manual processes. Examples of tasks that the system will perform:

- “Check that…” tasks.

- Any task that resides on a calendar

- Data import/export tasks

- Data controls (e.g. price checks, instruments parameter validations, etc)

If issues are found, the alternative investment technology notifies users, who can then take action. Limina’s investment management system has these capabilities built-in at no additional license cost.

We’ve observed that up to 10x more controls, checks and tasks are performed by managers with exception-based workflows enabled, without larger teams.

An interview with alternative investment manager Helix

Limina’s founder, Kristoffer Fürst, sat down with Matt McConnell from limited partner Helix. They discussed:

- Different views on how to group, categorise and track different types of assets ranging from real estate to art and close-ended funds such as venture capital and private equity

- The difference between what the Front Office and Back Office want to see

- Is crypto a currency, an asset or both? The way a system decides to model it will have implications

- History and future of alternative investment software

Watch the full video:

From my experience, every asset manager has their way of seeing the world and how they like to group, categorise and track different types of investments. What seems entirely intuitive and simple to us, is apparently foreign to others. So I think it’s great if you find something that enables flexibility around categorisation.

Limited partner software and more asset classes

Endowments, foundations, pension funds, insurance companies, family offices, and funds of funds invest in a wide range of asset classes. An effective investment platform must be able to support all alternative assets – and ideally all other asset classes as well.

The reason is that cash and exposure are portfolio-specific, not asset-class-specific. Any portfolio that contains multiple asset classes must, therefore, be managed in a system that supports all portfolio assets.

Examples of assets to be supported range from private equity and debt to real estate and infrastructure. It spans fixed-income, FX, all types of listed instruments and OTC derivatives. Complex hierarchical ownership structures must also be representable. Even if you don’t have all of this in your portfolio today, you might in the future. So we encourage you to look more broadly than just a limited partner software and select a truly cross-asset system.

Explore smoother workflows

See how Limina’s system can help you spend less time on daily workflows.

Get all portfolio data – validated – at your fingertips.