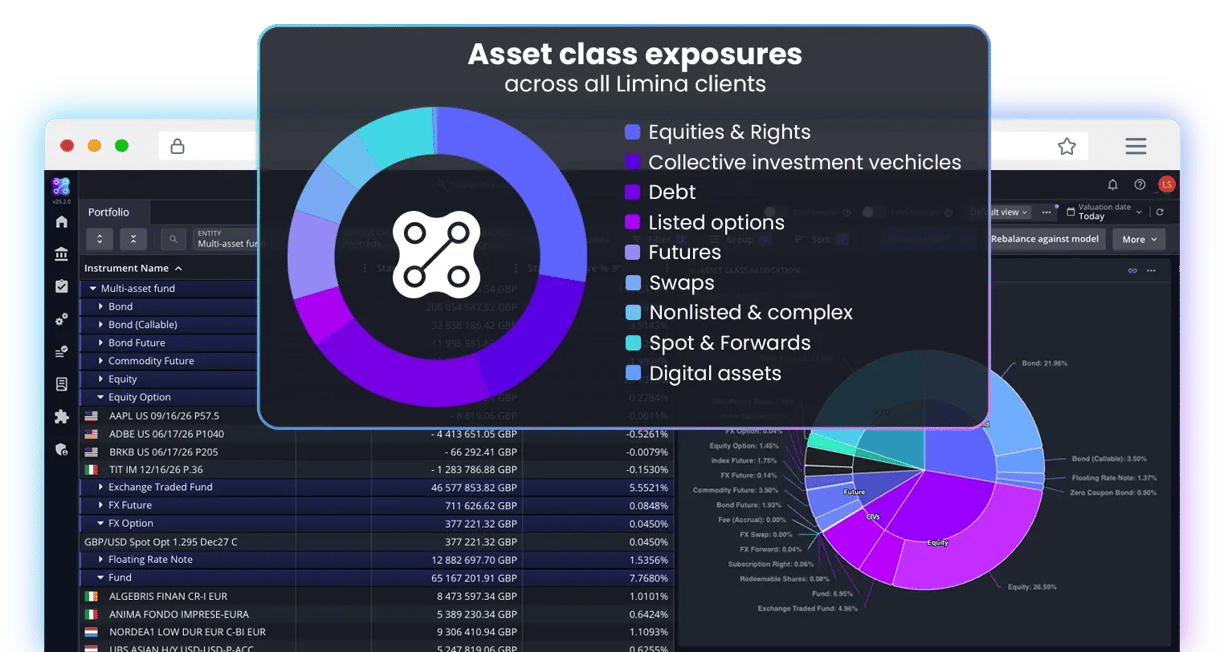

Limina IMS - natively cross-asset

One platform for all your assets

With Limina IMS, you get a platform with strong multi-asset support, and we are also proactively expanding into asset classes traditionally handled in separate systems (e.g. alternatives), as we believe the future is one one system where all investment management workflows reside and cash is centralised - for all your assets.

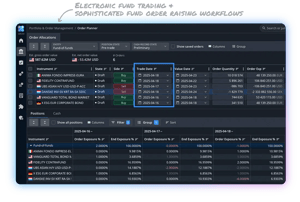

Funds / Collective Investment Vehicles

Limina includes sophisticated features that are especially useful if you're investing in funds, whether it's mutual funds, hedge funds, ETFs or REITs:

- Electronic trading; buy on amount / sell on units

- Expected trade & settlement day tracking, to ensure accurate projections of cash and exposures

- Look-through, both using constituents data and proxies

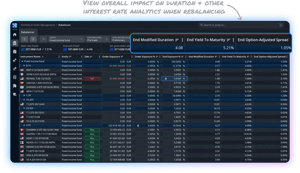

Fixed income

For fixed-income portfolios, notable workflows includes:

- Electronic workflows, even when phone/chat is used (VCON)

- Duration rebalancing

- Portfolio interest rate analytics

- Forward-looking cash projections (estimated coupons)

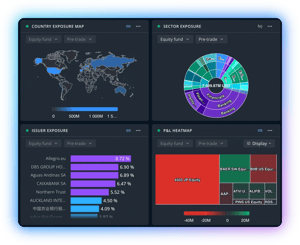

Equities

Efficiently manage equity portfolios:

- Handle T+1 & global markets with ease - accurate trade & settle date tracking (exchange open hours & settlement date offsets)

- Corporate action visibility; now and into the future

- Support any type of equity; listed/unlisted, ADR/GDR, redeemable shares, CFDs and swaps.

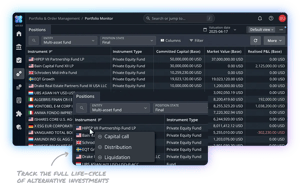

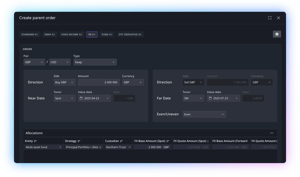

Alternatives (PE/VC, real-estate & infra)

Example of workflows especially useful if you're investing in alternatives:

- Plan for investments, capital calls and other events far into the future (weeks or months out). Add hypothetical transactions, and save your scenarios, without affecting today's exposures & cash

- Complete & correct tracking of returns, commitments & cash

- Look-through, both when you have constituents and using proxies

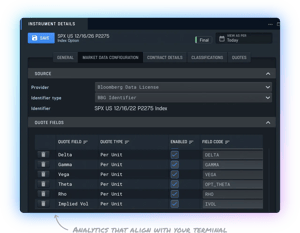

Listed derivatives

Natively manage portfolios with any type of future or option, with features such as:

- Exposure-based workflows (e.g. rebalancing)

- Analytics that 100% align with what you already see in the terminal

- Highly automated lifecycle management (expiries, exercises)

OTC

Swaptions, FX Options, and other OTC asset classes. Notable workflows include:

- Electronic trade connectivity

- Create custom instruments in your terminal and sync data with Limina via custom identifier (no copy-pasting)

- Correct and accurate P&L, analytics, scenario analytics, risk, etc.

FX

Example of workflows especially useful if your portfolio has FX:

- Any type of FX (NDF, outright, spot, swap & option)

- Electronic trading with any platform

- Generate FX directly from cash ladder (sweep) and order entry

See how Limina can help!

Want to see how Limina can help you save valuable time in your daily investment management workflows?

Why companies are switching to Limina

Get the latest research, insights and comparisons