Software for Asset Managers [incl. evaluation criteria]

Executive summary (tl;dr) - identifying the best investment asset management technology for you

Software for asset managers is a broad concept. It can mean an all-encompassing solution, covering functional capabilities from Front Office to validating NAV. It can also mean a point-solution, for a specific team or function – for example, just an asset management OMS (order management system) or covering a single asset class. The trend for most investment managers is towards broad solutions covering all or most functional areas and asset classes.

Key factors to consider when choosing the best asset management platform:

- Seamless Connectivity - Can you manage system integrations independently without coding, or are you reliant on the provider, incurring additional costs and delays? The ideal solution should offer self-managed connectivity for greater efficiency and control.

- Remote access & no IT overhead - A modern platform should be accessible from any device, including phones and tablets, with free upgrades that require minimal effort from your team.

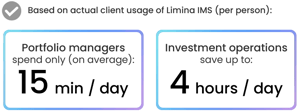

- Efficient workflows & cost reduction - To scale effectively, Front Office teams should not spend more time raising orders than necessary; the system shall do the heavy lifting here. Meanwhile, operations should leverage exception-based workflows, reducing daily processing time by up to 50%.

Positions and cash form the foundation of any Front-to-NAV (mid/back) software. There are 3 technical approaches to managing them, with the most flexible being the “live-extract Investment Book of Record (IBOR),” also known as “Generation 3 IBOR.” This advanced approach allows for dynamic portfolio views, enabling users to include or exclude preliminary, confirmed, and simulated transactions and cash across any time frame—past, present, or future—on both trade and settlement dates. Limina is the only live-extract IBOR that offers cross-asset, Front-to-NAV capabilities.

About the authors

The team at Limina has background in asset management. Having been in your shoes, we experienced a lack of unbiased and transparent advice about asset management systems (AMS).

This guide aims to offer what we didn’t have access to: a free, online-based overview of the aspects (functional and non-functional) to evaluate and compare when choosing asset management software.

Transparency disclosure: Limina is a provider of AMS (Front-to-NAV). To stand by our belief in transparency, we have created two public articles about when Limina is a good fit and when we might not be the right system.

All asset management workflows in one place

Limina IMS - an asset management system - combines the workflows you need with powerful data & automation capabilities - all in one solution.

What is an AMS (Asset Management System)?

An AMS isn’t well defined; more than that, it’s obviously software for asset managers. It can be a narrow solution in the Front Office, Middle Office or Back Office, then called a best-of-breed system (see the right side in the image below). Alternatively, an AMS can be an all-in-one (also called “Front-to-Mid, Front-to-NAV or Front-to-Back solution), illustrated to the left in the image below.

Limina can fit into any of these target operating models, illustrated in the light blue boxes. It’s also possible to use Limina as the core system to transition between operating models, most commonly from best-of-breed to all-in-one.

Why consolidate?

Asset managers are moving to all-in-one systems (away from best-of-breed). There are three drivers of this shift:

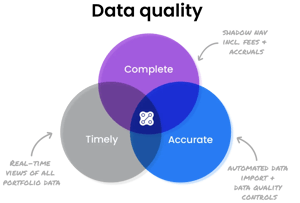

- Data is easier to control. The fewer systems you have, the fewer places there are for data to be incorrect or outdated. Limina uniquely has built-in investment data management capabilities to help you control and check data. Examples include quality controls (e.g. instrument validation and price tolerance checks).

- Cost can (most often) be reduced. With fewer vendors, you have fewer licenses. However, you’re also more reliant on one single vendor. If they increase prices, you might find it difficult to change to another provider swiftly. If you have fewer systems, there are fewer integrations to manage between systems, reducing complexity and costs.

- Operational efficiency. With one system, users don’t have to jump between systems to perform their workflows – be it operational or investment workflows. We’re seeing a new trend where asset managers consider workflow efficiency as part of evaluation criteria when selecting systems. Limina is designed to help your team spend less time on daily investment management workflows.

In this article, we’ll focus mainly on all-in-one solutions, as it’s become the most common type of technology in asset management.

Capability descriptions

Below are the 8 primary functional areas covered by an AMS. Some aren’t always present, not even in a front-to-back solution, and these are marked in brackets. We’ve also highlighted with underscore where Limina’s financial asset management software is uniquely strong

Investment Book of Record (IBOR) is the core of an AMS

IBOR refers to how a system manages the inventory of positions and cash. Since every asset management platform is stronger when the position and cash records are accurate, the IBOR approach significantly differentiates systems. There are 3 generations (or types / approaches) of how a system’s IBOR works:

- Flush & fill. When the portfolio is loaded in the morning (“start of day”) from a fund administrator or an accounting system.

- Rolling balance. Today’s portfolio is built from yesterday’s portfolio, plus today’s events. Accounting systems typically take this approach (both asset management-specific and general-purpose accounting systems).

- Live-extract. This model stores all transactions and cash movements but not positions and balances. Instead, positions and cash balances are created on request, with a specific cash state (preliminary or confirmed), investment state (simulated, in-market, committed, etc) and point in time (past, present, future).

It’s easy to think that a Gen-1 IBOR is the simplest approach, but it turns out to be just the opposite. It’s incredibly hard to keep track of what has been adjusted or not, especially when projecting things into the future like planned investments, coupons, corporate actions, etc – or when something goes wrong, such as a settlement failure.

The benefit of Gen-2 is that it can function independently (and so can Gen-3), making it useable for reporting, reconciliation and duality (something Gen-1 can’t achieve).

The main challenge with Gen-2 is that it stores only a single timeseries, so a view of simulated investments is just built from adjustments (same as with Gen-1). As a result, Gen-2 can’t achieve completeness and can’t handle more advanced scenarios, such as planned future trades.

Gen-3 IBORs ensure that any view (past, present, future) can be created for any purpose; simulating investment, reconciling cash to custody, creating the NAV view, etc. To our knowledge, there’s only one AMS built on a Gen-3 IBOR: Limina.

Note: Unfortunately, there’s no certification for the type of IBOR a system is. Most sales reps of AMS vendors won’t even know this about their technology solutions, so you must ask specific questions about use cases to uncover it.

Exception-based workflows

Limina enables smooth workflows and strong automation capabilities so you can get your work done quickly, from anywhere.

Considerations when selecting asset management technology

Six things to consider when evaluating an AMS – click on the tabs to read more about each topic.

Efficient workflows

Spending less time on daily investment management workflows is a priority for almost any asset manager. Here are two examples:

- Front Office: decrease time on implementing strategies. Once you know how you’d like your strategy to look (be it a single trade, a model or even an index), the system should do the majority of the work to ensure your portfolios are in line.

- Operations: adopt exception-based workflows. This means delegating issue identification to systems, and letting your team focus on issue resolution. Examples include tasks of type “check that X” and anything that’s currently a calendar reminder.

At Limina, we obsess over helping our clients increase workflow efficiency in the Front Office and adopt exception-based workflows.

Our reason to exist is to help asset managers spend less time on daily asset management tasks.

Integrations

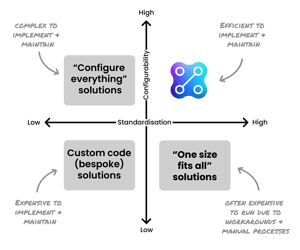

There are 3 connectivity/integration models for investment asset management software (read more here). Some cloud vendors go all-in on managed integrations, frustrating clients when an integration doesn’t exist yet.

Limina is unique in that we offer a self-service connectivity application as part of the platform. This tool requires no coding skills and lets your team quickly set up integrations to/from any data source (internal or external), even for complex cases.

Read more:

3 connectivity approaches

Furthermore, we believe you shouldn’t need a separate investment data management system. Data should be mastered and controlled as part of the AMS so the state of data is visible in real-time to all stakeholders (incl. Front Office).

Limina’s system has built-in data validations and quality checks for both standard and custom data (e.g., classifications).

100% Cloud - No IT footprint

You should expect technology for asset managers to come without IT overhead. Cloud-native financial software is available for asset managers of any size. We highly recommend discarding any provider that’s not cloud-native or Software-as-a-Service (SaaS). Note that some providers will claim they offer a SaaS asset management system, but won’t include managed upgrades – which means it’s actually not SaaS anymore.

Also, asset management SaaS solutions have varying degrees of remote and device accessibility. Limina, for example, sees 20% of logins from tablets and a bit less from mobiles – especially during lunch hours and evenings.

Read more:

Institutional grade software

Some software for asset managers focuses on simple requirements (e.g. single fund firms), while others cater to advanced workflows (leader-follower, model portfolios, etc) and specialised investment styles. We maintain a list of providers and their ideal use cases – please connect with our founder, Kristoffer Fürst, on Linkedin and request the latest version.

Limina is best fit for asset managers with medium-to-high workflow complexity, or if efficiency is an important consideration when selecting investment asset software.

Read more:

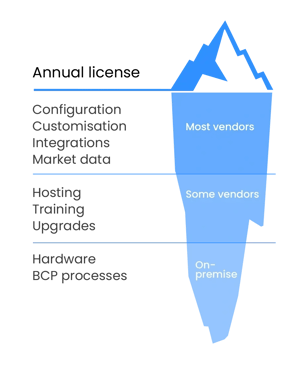

Reduce & control costs

The cost of asset management extends beyond the license/subscription price of the system (see image). Older technologies (even those masquerading as “modern” and “cloud”) can require significant costs for maintenance and upgrades.

The most critical (and unfortunately also most complex) factor to consider when it comes to cost is: workflow efficiency. We often observe clients save up to 50% of operational resources and 45min/day per portfolio manager by switching to Limina – the monetary value of that time often far exceeds the cost for the system.

Finally, a great indication of a modern provider is how they approach pricing. If pricing is public on the provider’s website, it’s a great sign they know how asset managers prefer to do business in this day and age.

Read more:

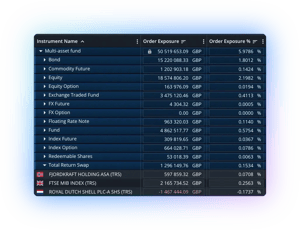

Asset class coverage

Previously, there wasn’t a front-to-NAV platform that could handle all asset classes effectively, forcing asset managers to rely on separate systems for each instrument type or resort to spreadsheets and other workarounds.

At the same time, it’s clear that the future operating model for asset managers is one central and broad system at the centre of Front Office (portfolio managers & trading software) and operational workflows.

This is why Limina was born: to address the need for a broad platform, both in terms of functionality and asset class coverage. Our clients invest in a wide range of assets across public markets (equities, futures, options, ETFs), alternatives, debt/fixed income, FX, OTC (swaps, options), and funds (fund-of-funds).

A lot more than "just another AMS"

See how Limina can help!

Want to see how Limina can help you save valuable time in your daily asset management workflows?