The Best Investment Books of Record (IBORs)

This article lists the two best Investment Books of Record available today: Finbourne and Limina. It starts with the history from 2013 onwards and how we got to where we are. This history takes us through how the perception of what an IBOR is has changed over time, and why only these two vendors are true generation 3 IBORs.

What happened around 2013-2014

The Global IBOR Standard, published in 2014, set out two different propositions for investment managers;

- What an IBOR for Asset Management needs to deliver to meet all the different demands on cash, transaction and position data that arise across the business functions of Asset Managers.

- A set of design criteria defining an architecture capable of delivering real-time aggregated position and cash views without reliance on start-of-day data from accounting.

The statement in the standard of what needed to be delivered by the best IBORs enjoyed general market approval. However, with the technology available then, it was difficult to create a fully capable IBOR according to the design.

The evolution of IBORs since 2014

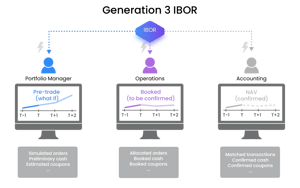

The standard envisaged a service rather than a database, where the IBOR creates better portfolio views, on request with the specification of the view submitted as part of the request. The IBOR stores all underlying transactions and cash movements, including potential amendments. Then, it creates consolidated views of positions and cash on the fly. This on-demand calculation results in a challenging requirement for performance in the IBOR engine.

To deliver the required performance, the transaction data has to be heavily indexed. This, and the need to store all states of all transactions creates an equally challenging demand for data storage.

Since the IBOR standard was published, technology and systems architectures have changed substantially. Storage is cheap, and the Cloud makes it possible to claim and release space quickly. Service architectures are omnipresent, and the idea that data is requested as needed is now well established. A heavy focus on indexes to enhance performance has become commonplace – after all, it’s how Google works.

Overall, delivery to the standard IBOR design criteria is much more practical nowadays. Consequently, we have begun to see established generation 3, live-extract IBORs solving problems in portfolio data faced by Asset Managers.

Our founder and CEO, Kristoffer Fürst, takes you through a full IBOR breakdown in the video above

A list of the best Investment Books of Record (IBORs)

The two best Investment Books of Records are listed below, in no particular order:

Finbourne

Finbourne’s IBOR design approximates, rather than follows, the 2014 standard design criteria. They developed this as part of a broader investment data store and have achieved significant market interest and engagement. Their solution is tilted towards reporting and back office use cases, replacing Accounting Books of Record (ABOR) and accounting systems in some cases.

Limina Investment Management System

Limina is taking a different slant on IBOR delivery. Rather than creating a stand-alone IBOR as a service, Limina has a generation 3, live extract IBOR as the basis for its functional platforms. Use cases span front office (investment decision making) and middle office (operational processes) such as:

The prospect is that this range will expand to provide a complete front-to-back infrastructure. Based on the IBOR standard design, Limina’s IMS has an unlimited range of position and transaction use cases.

Other vendors

Aprexo has also developed an IBOR design close to the 2014 standard. Carne has acquired them, and it remains to be seen what Carne will do with them in the market.

Intelligent Lagoon is a startup generalising the standard IBOR design to address applications within and beyond asset management, including aviation and pharmaceuticals.

Conclusion

The idea has come of age that data should be seen through the lens of the use case rather than in the form in which it’s stored. In other words, the core of investment data management should be separate from, and not limited by, the structure of the underlying data. That is what generation 3 IBORs seek to deliver and what it is now possible to deliver.