Fund Management Software Guide: Features, Benefits & Best Practices

Executive summary (tl;dr) - identifying the best fund management software for you

A fund management platform can be a broad solution (all-in-one), covering all functional capabilities a fund manager needs from Front Office to validating NAV. It could also be a narrow solution, covering just one asset class or one functional area (best-of-breed). There is a clear trend among fund managers towards all-in-one.

Top considerations when selecting investment fund management software:

- Smooth workflows & cost control. The most powerful lever for scalability, is ensuring that Front Office don’t spend their time raising orders (i.e. should be super fast & robust) and operations rely on exception-based workflows (saving up to 50% of their daily workflow time).

- Work from anywhere & no IT footprint. Can you access the system via phone and tablet? Are upgrades effortless? The answer should be yes for any modern platform.

- Connectivity. Can you control connections yourself (without code), or are you depending on the provider (cost & time delay)?

Positions & cash are at the core of any Front-to-NAV system. There are 3 ways systems (technically) handle positions & cash, the most flexible of which is the “live-extract Investment Book Of Record (IBOR)” (also called “Generation 3 IBOR”), which can produce portfolio views in any way (with/without preliminary/confirmed/simulated transactions and cash), at any time (past, present, future) and trade/settle date. Limina is the only live-extract IBOR with cross-asset, Front-to-NAV capabilities.

About the authors

The team at Limina is made up of former fund managers. We felt vendors always tried to put their solution forward as the best option, and found it challenging to find transparent and unbiased information about fund management systems (FMS).

This guide aims to offer what we didn’t have access to: a balanced overview of the aspects (functional and non-functional) to evaluate and compare when choosing fund manager software.

Transparency disclosure: Limina is a provider of FMS (Front-to-NAV). To stand by our belief in transparency, we have created two public articles about when Limina is a good fit and when we might not be the right system.

All investment workflows in one place

Limina IMS - a fund management software - combines the workflows you need with powerful data & automation capabilities - all in one solution.

What is a Fund Management System?

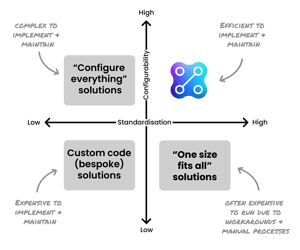

Fund Management Software (FMS) isn’t well defined; more than that, it’s obviously software for fund managers. It can be a narrow solution in the Front Office, Middle Office or Back Office, then called a best-of-breed system (see the right side in the image below). Alternatively, a FMS can be an all-in-one (also called “Front-to-Mid, Front-to-NAV or Front-to-Back solution), illustrated to the left in the image below.

The blue colour in the illustration above indicates where Limina’s FMS can fit, depending on your target operating model. Some clients start in one of the operating models, and use Limina as a catalyst to transition over time to another operating model.

Why consolidate?

In this article, we’ll focus mainly on all-in-one solutions, as it’s become the most common type of buy-side fund technology.

The main reasons why integrated fund management systems (“all-in-one systems”) are increasingly popular are:

- Reduced cost. Since there are fewer integrations to manage (resource intensive) and fewer vendors to pay a license, costs are reduced.

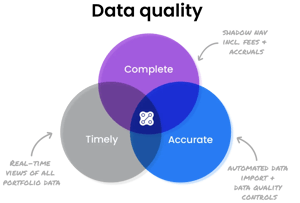

- Fewer data issues & automatic controls. With a single source of truth, you avoid data mismatches. Different FMSs approach data modelling differently, and the smoothest experience for you as a client is when data is standardised across asset classes and functional areas (as is the case with Limina). Some FMSs have built-in data quality controls (e.g. instrument validation checks) to save manual works and checks.

- Workflow efficiency. With one system, workflows can be designed end-to-end, thus saving time every day for both Front Office and Operations users. We’re seeing a new trend where fund managers now consider workflow efficiency as part of their system selection. Beyond core functionality, they ask prospective providers, “How easy is it to use?”—not just in ideal conditions, but especially when problems inevitably arise. We’ll explore this further later in the article.

Execution management systems are an exception to the consolidation, where it’s sometimes more efficient to have a separate system due to nuances of how the trading/investing process looks on an asset class level.

Capability descriptions

These are the main functional areas of an FMS. Marked in brackets are optional (not always present), and highlighted is where Limina’s investment fund software is uniquely strong.

The core of an FMS: Investment Book of Record (IBOR)

IBOR refers to how a system manages positions and cash. Since every fund portfolio management software must track these items, an IBOR is a necessary component. However, there are 3 generations (or types) of IBOR:

- Flush & fill (Gen-1). When the portfolio is loaded in the morning (“start of day”) from a fund administrator or an accounting system.

- Rolling balance (Gen-2). It works the same as flush & fill, but the system stores the start-of-day portfolios internally. This is the approach most accounting systems take.

- Live-extract (Gen-3). All transactions and cash movements are stored, not positions or cash balances. Any portfolio view is created on-the-fly, with a specific cash state (preliminary or confirmed), investment state (simulated, in-market, committed, etc) and point in time (past, present, future).

Historically, many found it more straightforward to use a Gen-1 IBOR, yet in practice, managing all of its adjustments turned into a significant headache. For example, you can’t fully trust your cash figures when you’re unsure what’s been adjusted - especially when issues happen, like a settlement delay.

Gen-2 struggles because it stores only a single view, so Front Office perspectives must be built through adjustments to that single view (same as with Gen-1). As a result, Gen-2 can’t achieve completeness and can’t handle more advanced scenarios, such as planned future trades.

Both Gen-2 and Gen-3 can function independently, making them suitable for reporting, reconciliation and duality.

Gen-3 IBORs ensure that everyone on your team - portfolio managers, traders, compliance, and operations - always sees precisely what they need. To our knowledge, there’s only one FMS built on a Gen-3 IBOR: Limina.

Exception-based workflows

Limina enables smooth workflows and strong automation capabilities so you can get your work done quickly, from anywhere.

Considerations when selecting fund management platform

6 things to consider when evaluating an FMS – click on the tabs to read more about each topic.

Clever workflows

We believe that streamlined, effective workflows are the best way to reduce time spent on non-alpha-generating tasks (and strengthen governance in the process). There are three main strategies to achieve this:

- Full automation. This is difficult and often not worth the hassle, especially in this complex, unpredictable industry. The many failed STP initiatives in the market are unfortunate proof of this.

- Squeeze the lemon harder. Doing more tasks faster - typically leads to only marginal gains, not transformative results.

- Exception-based workflows are when the fund manager software handles tasks of type “check that X” and only alerts your team if something unexpected occurs. Typical examples include data import/export, enrichment, and validation.

At Limina, we’re obsessed with efficiency. We’re constantly trying to help our clients adopt exception-based workflows and make order raising as robust and smooth as possible.

Our mission is to help our clients spend less time on daily fund management tasks.

Integrations & data validation

There are 3 connectivity approaches for fund portfolio management software in the cloud, each suited to different needs (read more via the link below). Limina stands apart by delivering a native data import/export app. This no-code tool allows your team to set up integrations in minutes, reducing cost and ensuring maximum integration flexibility.

Read more:

3 connectivity approaches

Some FMSs incorporate data management features, removing the need for separate investment data management systems. Limina is one such platform, with built-in data validations and quality checks for both standard and custom data (e.g., classifications).

Cloud-native & Zero IT

In today’s market, you should expect technology for fund managers to come without IT overhead. Fully managed, cloud-native solutions now serve any size and type of fund manager. The provider handles hosting, web and mobile access, and upgrades without charging professional services fees. If not, we advise removing that provider from your list - plenty of modern (cloud-based) fund management tools are available.

Whether you’re office-based, fully remote, or run a hybrid setup, cloud-based solutions have you covered. We built Limina FMS from scratch as a true cloud-native platform.

Read more:

Sophisticated workflows

Some software for fund managers focuses on simpler requirements, while others cater to more advanced workflows and specialised investment styles. We maintain a list of providers and their ideal use cases - feel free to reach out via LinkedIn to our founder, Kristoffer Fürst, for the latest version.

Limina FMS is most suitable for firms with medium-to-high workflow complexity, or those emphasising automation and efficiency in their platform selection.

As for custom vs. off-the-shelf vs. enterprise cloud, our experience shows that “enterprise SaaS (Software-as-a-Service)” is generally the best fund management software, aside from for the very smallest managers (sub $100m).

Read more:

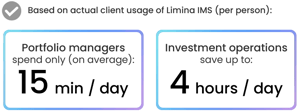

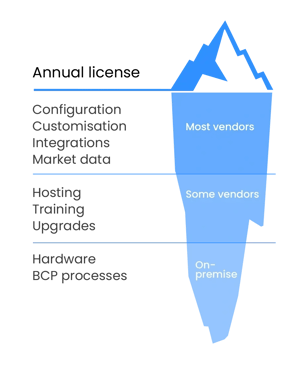

Reduce & control costs

When choosing a fund management platform, the total cost of ownership (TCO) typically extends beyond the system’s sticker price (see image to the right). Older technologies can require hefty costs for maintenance and upgrades - but modern solutions are now available that avoid these extra costs.

The most critical (and unfortunately complex) factor to consider is workflow efficiency, where your team can save (or lose) a vast amount of time (i.e. cost). At Limina, we’ve helped clients cut operational workflows by up to 50%, and the average Portfolio Manager now spends just 14 minutes per day in the system (previously over an hour).

We advise selecting a provider that publicly discloses pricing on their website. You deserve to know the costs upfront, and a transparent vendor is far more likely to be a true partner.

Read more:

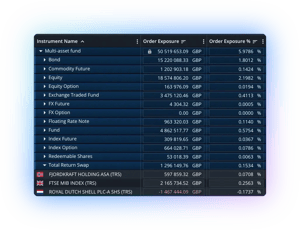

A cross asset system

Historically, there wasn’t a front-to-NAV platform that could handle all asset classes effectively, forcing fund managers to rely on separate systems for each instrument type.

Meanwhile, reducing the number of fund management systems is undoubtedly the future of operational efficiency.

That’s really all there is to say. Limina set out to develop a comprehensive solution, helping managers achieve a single platform with super-efficient workflows and automation. Our clients trade a wide range of products across public markets (equities, futures, options, ETFs), alternatives, debt/fixed-income, FX, OTC (swaps, options) and funds.

A lot more than "just another IMS"

See how Limina can help!

Want to see how Limina can help you save valuable time in your daily fund management workflows?