8 Total Cost of Ownership Drivers for an Investment Management System

We are often asked how the cost of Limina’s investment management system compares to other solutions on the market. First of all, our prices are public.

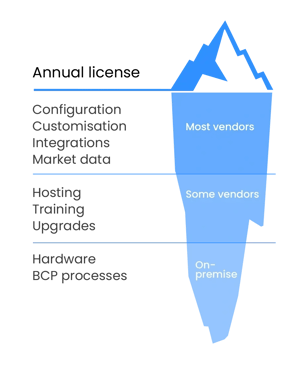

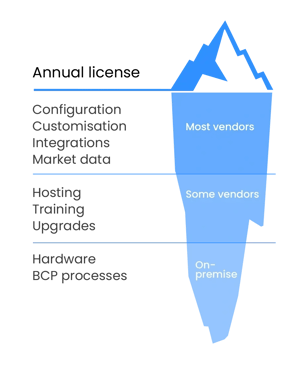

However, it's important to understand that the fee paid to a vendor is only part of the costs associated with implementing, owning, and maintaining an investment management system. The fee to the vendor can range from a small fraction of the total cost to the vast majority of it.

We have created this guide to give you insights into the different factors that affect the total cost of ownership of investment management systems, to help you to better understand and compare quotes from different vendors. Note, however, that we have not included possible price ranges for each section, simply because most vendors are often secretive about their pricing and public data is limited.

What is total cost of ownership?

Total cost of ownership (TCO) refers to all of the costs associated with acquiring an asset, plus the costs of operating and maintaining that asset, which are sometimes referred to as ‘hidden costs’. TCO can be applicable to any type of purchase, which means it’s not always straightforward to apply from one purchase directly to another. This is especially true for software and systems, as there might not even be an upfront cost and the ongoing costs of operation and maintenance often greatly varies. Furthermore, the factors that drive those ongoing costs also depend upon the type of software or system itself.

In this article, we explore the drivers of TCO and in our post about how much an asset management system costs - we go into numbers and examples.

The drivers of total cost of ownership for investment management systems

There are different drivers that impact the TCO of investment management systems. Understanding what the different drivers are can better equip you to compare quotes from different vendors, and achieve the best value that meets your firm's needs.

So, what are the key drivers of TCO for investment management systems?

1. Delivery mechanism

There are essentially three ways systems can be deployed, and these deployment types all impact TCO in different ways. These deployment types are:

- Software – also referred to as “on-premise”.

When code is delivered from the vendor under a licence, the client needs to pay for and manage hardware and/or virtual servers, both for production and also for BCP and UAT. The costs for servers, personnel server maintenance and technical upgrade processes need to be factored in for on-premise systems.

- Cloud-enabled – also referred to as “hosted”.

This is the same as software at the core, but the vendor also takes responsibility for hosting the software, specifically in the cloud. This means that costs for server capacity and technical upgrades of the investment management system are being offered by the vendor, usually as a separate part of the offer, i.e. not included in the license to the software.

- Cloud-native – also referred to as “SaaS” (especially in specific industries).

This is a completely different model, where there is no license at all but rather just a subscription (similar to how you subscribe to Spotify, for example), usually via your web browser. There are no extra or separate costs for hosting.

Both delivery mechanisms 2 and 3 are commonly referred to as Software-as-a-Service (or SaaS for short) in the investment management industry, while in other industries it is common practice that only cloud-native would be referred to as SaaS. For these kinds of systems built specifically for asset managers and asset owners, the most common deployment type is cloud-enabled, because a cloud-native solution must, by definition (“native”), be built for the cloud from the ground up.

2. Implementation and training

The part of the system’s implementation that remains irrespective of delivery model is project management, business decisions such as workflows, and configurations such as data controls.

Customisation in some form or another might be needed, depending on your business requirements. This usually adds to the upfront cost and therefore should be averaged over the expected period where the system is in use, to come up with an annualised total cost of ownership. Even if the vendor doesn’t allow customisation – which can be the case for all delivery types – there is still a direct cost to solve custom requirements outside of the new solution.

Training costs are lower as you move from on-premises to cloud-enabled to cloud-native, simply because there are fewer parts for the client to be trained on. For example, there is no need to train your team on software installation and maintenance.

3. Upgrades and support

In a cloud-native SaaS investment management system, upgrades are managed by the vendor. It’s important to note that this also includes testing. For deployed (software/on-premise) and cloud-enabled solutions, upgrade projects are usually required, and these can be done by internal staff or ordered by external consultants to do on a regular basis. For both deployment types, testing is required to be done by the client and can be a significant part of the total cost of ownership. This is usually one of the largest, and unfortunately least understood, hidden cost of any front office, middle office, or front-to-middle office system.

For a cloud-native solution, testing is usually optional and could be automated to a higher degree. Note that there is a difference between enterprise and non-enterprise release management, which means only some cloud-native solutions support specific governance processes around upgrades.

Technical support (e.g. integrations) is a factor that needs to be handled by the client in case of software or on-premise, i.e. the client is essentially supporting itself either fully or in part. For cloud-enabled and cloud-native deployments, support is delivered by the vendors, hence it’s important to check if it’s included in the licence/subscription fee, or if additional costs can be expected on top. If the latter, it should be added to the total cost of ownership calculation in a similar way as for software.

|

Software / on-premise |

Cloud-enabled / Hosted |

Cloud-native |

|

| License / subscription | License |

License or Subscription |

Subscription |

| Deployment cost | Servers |

Hosting |

- |

| Implementation | Server setup Software installation Training Config Customisation |

- |

- |

| Upgrades | Server upgrades Software upgrades Testing |

- |

- - - |

4. Future changes to your business

As your business develops, you will inevitably have changing requirements on your investment management systems. It is rare that the vendor you work with will support your new requirements without additional costs, although sometimes it does happen, especially if you have opted for a SaaS model for your investment management solution.

If your vendor has the functionality you need, it means there is likely a discussion to be had about a different licence (i.e. paying more for your investment management, order management or IBOR systems). In case this isn’t available, you could ask the vendor to develop it (with or without cost), or you will end up having to resort to building a process outside of the investment management system. This should not be overlooked as it’s unlikely that a vendor can service all clients perfectly, especially over time as the client base grows. We recommend that you ensure maximum flexibility, which can benefit your TCO over time as well as business development.

Furthermore, it’s important to understand what happens to the licence or subscription fee if a new integration or interface needs to be set up. What happens if that integration doesn’t exist or needs to be tweaked? For example, for a specific asset class not yet supported, is there an additional ongoing fee and/or upfront development cost?

We appreciate that budgeting for future changes is difficult because they are - by definition - unknown. However, there are ways to make reasonable approximations in your total cost of ownership calculations. Contact us if you would like to know more about how to apply this in your unique circumstance.

5. Sell-side billing model

Some order management systems in particular, but also some investment management systems, charge the sell-side – sometimes referred to as soft dollars. These fees can account for more than 70% of the vendor’s revenue (data reference has been removed from online since publication of this blog post). This is a real cost as it will affect how brokers evaluate their entire engagement with a client. It is, however, very difficult to account for in a TCO assessment, since often these fees are not transparent. If the vendor doesn’t show these fees, one way to account for it is to apply a markup of up to 200% on all the costs listed here under sections 1, 2 and 3 for vendors that apply sell-side charges, to give you insight into what the total cost of ownership may likely be.

6. Other switching costs

Beyond implementation, there might be a need to make organisational changes when implementing a new solution. Sometimes there is a cost associated with this and sometimes there is a saving. Regardless, it is important to include it in the total cost of ownership analysis when contemplating a new front-to-middle office system.

You might also need to run systems in parallel, depending on the approach to go-live you choose - big bang or piecewise/sequential. If you choose the latter, you need to include costs for both systems for a period, and consider staff requirements during the transition period, too.

Of course, in practice a system switch might not be like-for-like; there might be a change in operating model such as outsourcing part of the middle office, back office or trading functions. These could be sources of additional costs during a transition period if both setups need to be maintained in parallel.

7. Market data

The cost of market data can be affected by the investment management system you choose. Usually, there won’t be additional real-time fees directly from the exchange, assuming proper permission controls are available (this is something worth checking).

There might, however, be a requirement to either purchase additional market data products from your market data vendor or add additional terminals for access. Usually only one of the two will be present, and it should be added in the total cost of ownership analysis.

8. Opportunity cost

Opportunity cost is not a direct cost, but rather loss of revenue. This category does not usually form part of a total cost of ownership calculation for an investment management system conducted by an asset manager. However, it is very, very important to include in an evaluation.

If you choose an investment management system that does not optimally give you the ability to generate alpha in your way, it can lead to loss of AuM over time. Other potential examples of opportunity cost in relation to an investment management solution include:

- Not being able to provide the best possible experience to your investor.

- Bottlenecks in operations, causing staff to focus on activities that are not value adding or even worse, making a high-impact mistake.

- A compliance breach, e.g. due to inadequate portfolio data within pre-trade compliance.

Summary

Whilst the benefits of adapting modern investment management technology for an asset manager are clear, it’s important to be mindful of the total cost of ownership when selecting your vendor or partner, including factors like hidden costs and “soft dollars”.

Considerations such as what infrastructure the system is deployed on, how it’s implemented and maintained, and what type of relationships the vendor has with the sell-side are all important aspects that affect the TCO. Doing an estimate of how the cost of ownership will look over time, including up-front investments and switching costs, is important in order to understand the true return on investment in your system selection, and to compare vendors like-for-like from a cost perspective.

Finally, the right Investment Management Software can help you make money. Check out our article on Operational Alpha to find out how.