How Investment Managers Can Reduce Cash Drag

In this post, we explore what cash drag is and how to maximise your investment level with confidence. In other words, how to avoid cash drag as much as possible.

What is cash drag?

Performance drag is the difference in return over time between what a portfolio “should” theoretically return and the actual return after fees and other “drag” effects on its performance. The simplest example is the difference between an index and an index-tracking fund. The index tracking fund will never fully track the index due to performance drag (also called tracking error).

In this article, we’ll focus on cash drag, which is performance drag caused by a portfolio not being fully invested.

What problems does cash drag create?

As the market increases in value over time, holding cash will directly mean that your portfolio is getting left behind your benchmark. Every dollar not invested is – on average - a missed positive return.

As a simple example, if the average expected return of a portfolio is 10%, then having 0.25% (25 bps) cash reserve will have a 0.025% (2.5 bps) performance impact. It might not sound like a lot, but the amount is material if you’re an asset manager with $10bn under management. Use our operational alpha calculator and try various examples yourself.

An example of cash drag in action

A portfolio manager often wants to invest to the edge of what’s possible. Imagine for a moment that you have 1% in cash. You want to deploy that cash pro-rata across your portfolio. But how much of the 1% do you dare deploy?

The decision puts a lot at stake. If you invest too much, you might become a borrower, leading to heavy fines and the need to issue a breach report to your investors. But if you leave cash sitting uninvested, you miss opportunities for returns.

You need to know with certainty how much you can invest, whether 99% of your cash or 99.9% of it.

Fee pressure has made reducing cash drag even more important

Given the state of the investment industry, peak performance has never been more critical. A PWC report predicts fees will continue to decline, reinforcing the need to reduce cash drag to improve investment performance.

This trend is increasing competition between asset managers, a reality that makes performance and reducing cash drag even more important. If a portfolio manager can be more invested by even a tiny amount, they may see a three bps (0.03%) increase in return, causing their performance to rise relative to their peers. A bump in performance increases the chances of higher net new money.

It all comes down to the main goals - deliver outperformance and grow your AuM.

How to reduce cash drag

The hypothetical investment conundrum above illustrates the importance of high-quality portfolio data when attempting to reduce cash drag. It's critical to trust the data in your systems to inform you of the state of your data in real-time so that you can understand how accurate and complete your data is before making investment decisions.

What is data quality?

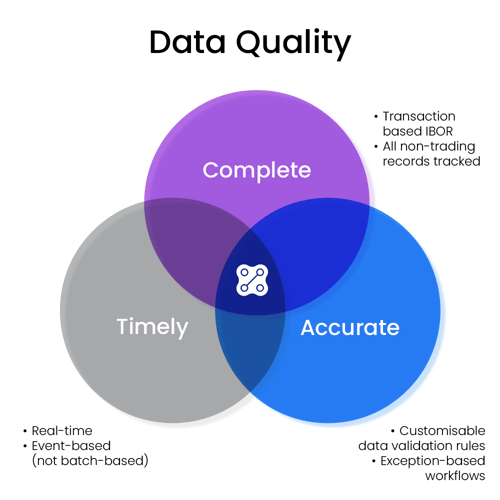

So, how is data quality for an asset manager achieved?

- Complete data – All portfolio events tracked, including both trading and non-trading related records. Cash is built up of movements, not imported from admin or custody

- Accurate data – Automated data validation checks

- Timely data – All portfolio events processed in real-time

Quality data reduces cash drag

With the help of high-quality portfolio data, you can manage your portfolios conservatively and aggressively simultaneously, helping to reduce cash drag. The two philosophies aren’t mutually exclusive. Instead, they unite to demand precision.

Complete data protects your cash from overdrafts and mitigates significant operational risks. At the same time, trust in your portfolio data makes it possible to increase your investment level to the limits, unlocking the potential for additional returns and reducing cash drag.

How to ensure your portfolio managers are looking at high-quality portfolio data

Data quality in an Investment Management Solution (IMS) depends on correct calculations and the delivery of high-quality data from multiple sources. Such sources include custodians, brokers, index providers, valuation providers, the security master(s), and market data feeds. The IMS can solve some issues, but not all. This is precisely why visualising data quality in real-time is paramount for portfolio managers to reduce cash drag through confident, high-return investment decisions.

Summary

Cash drag can reduce your portfolio returns and harm your portfolio performance. Increasing data quality in the investment decision process can maximise investment returns through improved decision-making. Investing in advanced investment management solutions will enable you to maximise your investment level with confidence, thanks to high-quality data insights that are accurate, complete and timely.

If you’re curious to know more about Limina, contact our team or explore our solutions and discover the benefits of Limina’s Investment Management Platform.