How Limina helps asset managers enable

Faster business development

Our unified multi-asset platform can help you easily navigate changes in operating models and new launched products/strategies.

Flexible workflows for all operating models

Regardless of your operating model, Limina’s cloud-native and flexible solution will support you both today and in the future; should you decide to make changes. For example, we have helped clients:

- Outsource trading fully/partially

- Outsource data management

- Outsource middle/back office

- Adopt a centralised or distributed operating model

Multi-asset class coverage

Limina’s multi-asset platform can help you expand into:

- Fixed Income

- Equity

- Funds

- Derivatives

- Digital Assets

- Cash

35% of funds are externally managed at Avanza - All launched after Limina was implemented

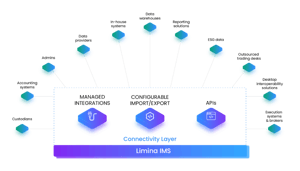

Extensive and cost-effective connectivity

75% of asset managers struggle with cost and timeline for new and changed integrations.

With the built-in configurable connectivity engine, you can master integrations in minutes without relying on us.

How we can help you develop your business faster

Learn more about how we help clients:

Empower your operations team with the right software solutions to increase operational efficiency and productivity.

READ MORE

Looking to enhance your investment process oversight? Liminas' IMS can address these challenges.

SEE MORE

Is an annual system fee eating into your budget? Discover how to reduce system costs without compromising efficiency.

Read More

Experience increased stability, security, and cost savings when you Modernise Your Systems with Limina.

Read More

Looking to enhance your bottom line by reducing your cash buffer and generating alpha?

Read More

Trust in data is paramount. If your front office don’t trust the data how can they make informed decisions?

Read More

The right IMS can make developing your business faster and smoother, from launching new strategies to changing operating model.

Read More

Still using spreadsheets or in-house systems for your Investment Management Solution? Make pre-trade compliance and workflow audits easier.

Read More