Guide to investment accounting software, for funds & other portfolios

Introduction: Portfolio accounting vs fund accounting

What is a portfolio accounting system? What is fund accounting software? This article uses “fund” and “portfolio” interchangeably. Technically, a “portfolio” is a broader concept and a “fund” is a type of portfolio (usually regulated in some way).

We include traditional asset managers and pension trusts, fund administrators, church fund accounting software and local governments in the terms used here, as the difference between these use cases is small.

A last note before we get started: we’ll use the acronym IAS for Investment Accounting Software throughout this article.

NAV & Ledger

Calculating NAV is at the core of what an IAS does. The actual NAV calculation can support various cutoff times for different portfolios and locked accounting periods. NAV for multiple share classes and formal approval processes are all table-stakes for an IAS. Some will also support GIPS-compliant calculations.

Not all portfolio management accounting software will have general ledger (or subledger) capabilities. If you require a balance sheet and chart of accounts, double-check that they are available.

Standard capabilities of investment accounting systems

- Audit, incl. reports

- Multi-currency support

- Cross-asset support, incl. real estate, derivatives (OTC & listed), equities, fixed income, infrastructure, funds (mutual, hedge, ETFs, VC, PE…), etc.

- Delivery mechanism: on-premise, hosted or some variation of cloud. Read more about enterprise cloud options in our deep-dive guide on the subject.

Different types of entities using IAS

Many different types of firms can use an IAS. The same IAS product can, for example, serve as:

- Government fund accounting software

- Fund accounting software for churches

- The IAS underpinning a global asset management giants

As long as the pricing model is flexible and the system supports all asset classes and a wide range of investment strategies, including large sets of portfolios.

Data into the portfolio accounting software

Investment portfolio accounting software can ingest data in 3 different ways to get data into the system:

- Managed integrations

Best for : plug & play connectivity, suitable for highly standardised integrations - User-configurable import/export application

Best for : configurable connectivity, suitable for most integration types – especially bespoke ones.

This functionality is unique to Limina. See an intro video here. - APIs

Best for : technically tricky integrations. However, it requires technical resources and introduces IT overhead - Manual upload / entry

Best for : when no other option is available, or it's a one-off import

Limina’s unique import/export application is a native Extract, Transform & Load (ETL) application - a no-code tool that lets your team build any integration in minutes.

When evaluating connectivity features, it’s important to include monitoring requirements. Some systems can notify users of issues (exception-based workflows), such as if data didn’t arrive on time or the format was corrupt.

Data generated by the investment accounting software

The best portfolio accounting software will automatically enrich information so your team can spend the least time on data entry. Examples include:

- Trade entry

Even if you don’t use a trade matching solution, trades can (and should) pass through the system fully STP (straight-through processing). - Transaction fees & taxes

For example, commissions and stamp duties. - Accruals

The system automatically creates daily accruals. - Corporate actions

Taking a dividend as an example, when a corporate action ex-date arrives, the system should automatically create the cash flow with projected settlement on the pay-date in each portfolio that holds the equity. - Position lifecycle events

For example, when a coupon payment is due, the system should automatically create the cash transaction.

Uncommon capabilities of investment fund accounting software

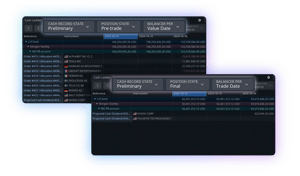

1. Trade and settlement views in parallel

An IAS interfaces with custody and is the NAV/ledger. It also serves the Front office (either through reconciliation to an OMS or by having built-in OMS functionality). These 3 use cases all require different versions of the portfolios (cash and positions), and the best fund accounting software can do it all with the ability to show:

- Cash and positions at different dates, i.e. both commitment date and settlement date.

- Cash levels, including and excluding preliminary cash.

- Cash and positions with all orders (any stage), matched trades and only settled transactions.

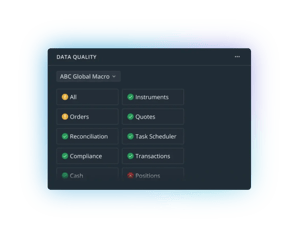

2. Data quality controls

Automatic data quality controls are a natural part of an IAS, and surprisingly, few platforms support it. Examples of controls include:

- Validate that instrument parameters are set, e.g. optional classifications used for compliance or reporting

- Check for stale prices or large price movements, where the definition of “large” is configurable

- Control that data that should’ve arrived actually did, e.g. files or SWIFT messages from custody didn’t

If anything unexpected happens, users are automatically notified – which we call exception-based workflows.

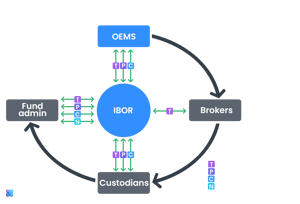

Reconciliation is expected in a modern IAS

Before producing the NAV, it’s essential for investment accounting solutions to ensure that the data they have is accurate. With data automatically generated and data quality controls, it’s unlikely that there are inaccuracies at this point. It’s still a good idea to reconcile as much data as possible with as many parties as possible.

You can always reconcile against the custodian, at least part of the data – but now always on trade date (custody might only have settlement date reports). If you’re the investment manager and have a fund admin, you can reconcile against their view. If you’re the administrator, you might be able to reconcile with the investment manager if they have an accounting book of records.

Finally, reconciliations can (and therefore should) be fully automatic. You shouldn’t have to import/export data manually or open a single spreadsheet as part of this process. The IAS should be able to notify you if any mismatches require your attention. Get a no-strings-attached demo of Limina’s automated reconciliation.

If trade volumes are high or you’re investing in emerging markets with complex fees and taxes, it’s usually a good idea to reconcile trade quantities, prices, fees and taxes on transactions. This reduces the number of potential reasons for cash balance breaks.

The confirmation and affirmation process is automated if you’re using a trade matching platform. Consequently, in such scenarios, there is no need to reconcile transactions.

The system will catch any corporate action discrepancies in the position or cash reconciliation. Therefore, it’s usually only worth the overhead with corporate action reconciliation if there are multiple sources for corporate action data or if the number of corporate actions is high.

Reconciliation of positions includes, at a minimum: instrument held, price, currency, market value, quantity/notional and cost basis (acquired price / tax lots).

Anything that could affect positions is caught in this step, which is why it’s 1 of the 2 most crucial reconciliations.

Cash balance reconciliation with custodians (bank accounts) is the ultimate reconciliation. Almost everything affects cash, so the entire portfolio is likely accurate if cash matches. Examples of things that affect cash:

- Trading

- Subscriptions/redemptions

- Positions lifecycle events (dividends, coupons)

- Accruals

Custodians might not have trade date cash (only settlement date cash), so it's important for the IAS to support both. Ideally, reconciliation of both captures discrepancies early as well captures settlement issues.

Reconcile the P&L of the portfolio, including asset positions (market movements and lifecycle events)—and NAV reconciliation, including on a share class level.

Note that if you’re the only party doing accounting for a portfolio, there might not be another source to reconcile P&L and NAV against. This is usually okay as long as cash balances and positions match, but the likelihood of P&L and NAV being incorrect is very small.

Additional functionality of investment fund accounting software

Additional functionality that only the best investment accounting software has includes:

- Portfolio rebalancing

- Performance (contribution and attribution) and risk

- Exception rules beyond pricing, e.g. NAV tolerance, P&L, bps change, compared to index, and biggest contributor (positive & negative)

- Dashboards for internal use

- Reporting & data export. Including technical formats like CSV, integrations to BI-tools, Excel-plugin, API and scheduled reports.

- Finally, an IAS can be a module of a broader front-to-back or front-to-mid solution.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - the team at Limina is happy to advise on any questions you may have about enterprise investment management software and how it can fit into your landscape and support your target operating model.