Broadridge Paladyne OMS & Portfolio Master

On this page we explore challenges with Paladyne, and Limina as an alternative. At the end of the page, we cover functionalities and a history of Broadridge Paladyne.

Note: Vendor information here is based on company websites, industry publications and online review sites such as G2, Gartner, TrustRadius and Capterra. Such pages have been reviewed in May 2025 as a basis for this article.

Why clients opt for Limina

User-configurable workflows, access from any device (without VPN) and flexible report/connectivity.

What clients are saying

By adopting Limina's scalable platform, Avanza has launched 33% additional funds without having to scale its investment operations team. They achieved:

- Decreased dependency on single individuals - by replacing spreadsheets

- Improved operational efficiency - by increased automation

- "It’s such a modern portfolio management system – not only because it’s cloud-based, but the entire process flow and information I get is complete and up to date. It’s simple to use, flexible to work with, and it minimises the time for the entire trade workflow." / Portfolio Manager

- "Limina helps us reduce operational risks." / CEO

What makes Limina different?

Modern user experience

- Full-feature access from browser and tablet

- Native mobile app

- Slick & efficient workflows

All workflows & assets in one system

All the workflows you need - combined in one solution with powerful automation capabilities & built-in data controls.

All asset classes supported, including funds, alternatives, FX (and everything else)

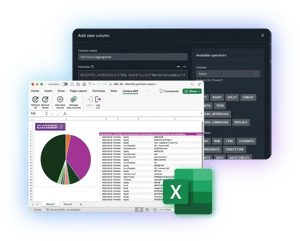

Create any report in seconds

Easily build and maintain your own custom reports. Export on schedule or natively into Excel via the Limina Excel plug-in.

Other report destinations of data include email, BI-tools, data warehouses, fund administrators, internal tools and more.

Connect to anything & anyone

Greatly reduce the time spent on manual data input and extracts with Limina's powerful connectivity:

- Standard connectivity to the most popular data & service providers

- Easily build, schedule and maintain your own custom integrations in minutes to anywhere: custodians, internal tools, data warehouses, admins, and more

Efficient processes = Save money

See the next market leader in action

If you're looking to get ahead, and stay ahead, why not schedule a no obligation demo with us at a time to suit you?History and evolution of Paladyne systems

Sameer Shalaby, Sol Zlotchenko, and Scott Alderson founded Paladyne Systems in 2005. The company quickly gained traction among hedge funds, and in just 6 years grew to servicing 150 clients with 160 staff. Following the quick growth, in 2011 Paladyne Systems was acquired by Broadridge (NYSE:BR), an S&P500 fintech company.

Our understanding is that the product has been renamed to Broadridge Portfolio Master since, but we struggle to find an announcement for the renaming. That product is being pitched to service asset managers (as well as hedge funds), although no data on asset managers serviced is presented.

Over the years, Paladyne has continuously evolved its product suite to meet the changing needs of its clients. The modular Paladyne Suite includes:

- Order management

- Portfolio management

- Reference data management

- Investment data warehouse and custom reporting

- Reconciliation

Non-functional breakdown of Paladyne OMS

- 01 Integrations

- 02 Efficiency

- 03 Neutrality

- 04 Hosting

Integration with 3rd party systems

Paladyne Portfolio Master integrates with various third-party systems, including portfolio accounting applications like Advent’s Geneva. This integration ensures a smooth data flow between systems, reducing manual intervention and minimising the risk of errors.

However, since Broadridge manages the integrations, you’re dependent on their resources being available if you need to make changes or add integrations. There might also be costs associated with integrations.

Limina takes an entirely novel approach to integrations, which removes all costs and vendor dependency without any downside (no developer resources needed).

Report based

Paladyne Portfolio Management System is a report-based system.

- Pro: It allows users to generate bespoke reports that meet their needs regarding the data they want to see.

- Con: Users build reports as a workaround for workflows the vendor could’ve supported natively. This consumes time that could’ve been spent elsewhere.

Book a Demo of Limina’s platform today to see how we’ve solved reporting and how more efficient workflows will save you up to 4 hours daily!

Broker neutral

ASP solution

Paladyne is an ASP (not SaaS), which means it’s a hosted solution. The vendor takes what used to be software and runs it on servers.

- Pro: you get one environment for just you (single tenant). You can be sure that your data is isolated from all other clients.

- Con: hosting costs are usually higher. Access might not be via browser/app (but via VPN). There is a higher risk of downtime.

Limina has a model where we can deliver SaaS (browser access) and isolate data between clients. We call this the 4th Generation Investment Management Technology.