3rd generation IBOR

Cash and position management software

At the heart of Limina IMS is a powerful Investment Book of Record, one of only two solutions that adhere to the 2014 Global Standard. As former investment managers, we appreciate transparency. Hence, we back our statements with facts, so here is a template checklist with capabilities and a transparent comparison of the Standard to Limina’s IBOR.

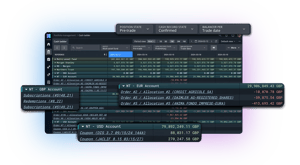

The multi-asset and live-extract capabilities empower your investment team with complete and accurate portfolio views suitable for the wide range of use cases spanning the Front and Middle Office.

THE IBOR INDUSTRY STANDARDS

Positions and cash management

A clear real-time portfolio view is of fundamental importance regardless of your investment strategy.

Specifically, without an accurate, forward-looking view of cash, firms may be forced to keep cash buffers to protect themselves against overdrafts.

In today’s reality of ever-increasing fee pressure, every basis point counts – so don’t lose out on valuable performance from not being able to be fully invested.

The Investment Book of Records also enables position and cash forecasting and simulations. The real-time position management capabilities are available out-of-the-box and, without reliance on batch processes or externally maintained Investment Book of Record solutions.

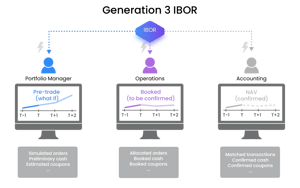

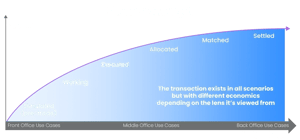

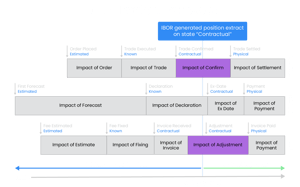

All transaction and cash states supported in one IBOR solution

Features enabled by the IBOR include optionality on what position state to view positions and cash: from pre-trade to allocated and matched trades. The multi-state concept makes the solution equally suited when simulating orders (including cash forecasting in real-time) and operations reconciling against accounting.

A consolidated IBOR platform to enable scalable operating models

The Investment Book of Records concept was popularised a decade ago. Now, ten years later, the benefits of establishing an IBOR are clear:

- Improved basis for decision-making

- Operational efficiency

- Improved governance and oversight

- Avoidance of compliance issues from different teams looking at disjointed data sets

- Golden data source to power other in-house or external solutions

IBOR as part of an IMS

Despite these apparent benefits, we have seen two factors holding back the mass adoption of standalone IBORs:

- Without combining an IBOR with functional capabilities, the business case is not as obvious, and hence, many have opted not to start projects in the first place

- For many investment managers who have embarked on IBOR initiatives, it has proven difficult to reach the expected ROI due to implementations being complex, costly, and insufficiently integrated into the core workflows of the firm.

Limina Investment Manager Software addresses both challenges with its IBOR natively integrated into the core workflows of the Front and Middle Office operations. This integration is made possible through the platform being designed from the ground up as a service-based architecture with an IBOR at the heart that powers the workflows in trade order management, portfolio tracking, investment compliance monitoring and more, rather than these being separate products.

By having just one Front-to-Middle office solution, many common issues are eliminated, such as:

- mapping of instrument definitions

- reconciliation of quotes and valuation policies

- expensive bespoke integrations

And for connectivity to other systems and service providers, Limina offer managed connections and a unique integration builder, that business users can use to set up new integrations in minutes. Follow the link for a video on how it works.

Supporting performance, risk and business intelligence solutions

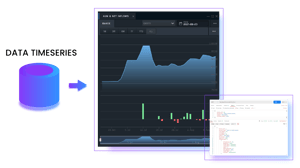

Limina’s position management system offers a consolidated source of real-time investment data, including bitemporal time-series data (“as at” and “as of”), with full audit and permission controls. Having both perspectives in the same solution makes Limina’s IBOR suitable as a golden source of portfolio data for investment managers, which can power other solutions such as reporting solutions.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.