Comprehensive Multi-Asset Software: OMS, PMS, Risk & IBOR Explained

Cross asset system

When selecting an all-encompassing system, there are 4 dimensions to consider;

- Asset classes

- Total Cost of Ownership (cost of systems, maintenance & team efficiency)

- Functional capabilities & operating model (i.e. your system landscape)

Generally, the trend is towards broader systems in both of these.

In this article, we’ll cover what functional areas multi-asset investment management software is best suited for. The illustration below highlights the functional capabilities of an investment manager’s operating model. The five columns represent potential operating models, from front-to-back to a best-of-breed. Clients of Limina can have any, and some use Limina as a lever to start in best-of-breed and gradually move towards best-of-breed.

If you’re unfamiliar with the terminology here, we have an article that goes deeper on the differences between OMS vs PMS vs EMS.

- OMS

- EMS / Trading

- PMS

- Performance & Risk

- Ops & Data

Multi-asset OMS

An Order Management System (OMS) covers order-raising workflows, e.g. rebalancing to a model or benchmark – and more complex scenarios such as leader-follower setup and automatic managed account (SMA) handling, including pre-trade compliance.

From there, orders are routed for execution via brokers, Execution Management Systems (EMS) or outsourced trading providers. A cross-asset OMS can support anything from exchange-traded, to fixed-income and even fund investments electronically. Some assets, like alternatives, are mostly manual from a transaction handling perspective (but must still be supported).

The OMS manages all downstream transaction communication, such as allocation, matching, trade files, and even settlement instructions (SSIs).

It's important for an OMS to be multi-asset because:

- Your portfolio planning becomes across entire portfolios, seeing cash holistically.

- Compliance checks are performed on full portfolios with a complete picture of all assets (e.g., issuer exposure, where an issuer can have issued multiple asset classes).

- All trade operations workflows downstream are seamlessly connected (as opposed to fragmented across multiple systems).

Multi-asset trading software (EMS)

Trading systems (Execution Management Systems) might be the best candidates for a separate system per asset class. This is because the downside of having a system for each asset class is low, and the upside is high.

- Downside with one EMS per asset class. There is not one place to oversee all trading. However, the real-time status of all trading can be fed to the OMS, where users can see assets holistically. You can also leverage the OMS for reporting, such as counterparty analytics and TCA information (no need to rely on the EMS for this).

- Upside with one multi-asset trading system. It’s simpler for users to have one system where they manage all trading. This is especially true for dealer teams responsible for multiple asset classes and investment types – for example, one team overseeing both fixed income and equity, instead of two different teams. However, they still see all assets in the OMS in real time.

Multi-asset portfolio management software

Portfolio Management Software (PMS) has two interpretations:

- For Asset Managers and Asset Owners: A tool to analyse hypothetical changes to portfolios or model portfolios. For example, see the impact of a model change on multiple portfolios compared to their benchmark. Plan cash and exposures in time so that settlement matches up and exposures are aligned to day-by-day targets. Finally, monitor the portfolio metrics you want (exposures, sensitivities, committed capital, yields, etc).

- For Hedge Funds: A mid-to-back office application, which we cover under the “Operations” section in this article.

The trend is clear: most investment managers want multi-asset portfolio software. As soon as you have multiple asset classes in just one portfolio, you need a system to cover all those assets. To understand why, consider the alternative where you’d have private investments, equities and fixed income in three different portfolio management systems. Making changes would mean you don’t see exposures or cash holistically, so you can’t accurately plan cash – leading to cash drag.

Performance & Risk systems

Two functional areas are less necessary to have as part of an all-in-system: risk and performance attribution systems (the latter less applicable for hedge funds). The reason is that these are simpler to integrate, with data flowing in one direction once per day – as opposed to bi-directional in real-time or multiple times per day.

It’s still critical that these systems are cross asset, because numbers won’t be accurate otherwise. Many risk calculations aren’t linear, i.e. aggregating them doesn’t give a correct number.

The best multi-asset risk systems are Axioma (acquired by SimCorp / Deutsche Börse) and MSCI Barra. At Limina, we provide multi-asset risk software as part of the system, through a partnership with Axioma. Numbers are natively embedded in the Limina web user interface (no need to log in elsewhere).

Operations & Data management

Within operations, you have functional capabilities such as reconciliation, shadow NAV, cash management, corporate action & position lifecycle management. These are impossible or at least hard to perform per asset class. In reality, NAV and cash don’t exist on a per-asset class level, so any attempt to create slices and aggregate them will create significant overhead with no upside.

Within investment data management, asset class specific functionality might include:

- An example of automated data quality control is price checks. A stale price or large movement for an equity differs significantly from a bond. A sound system has these types of checks built-in, configurable per instrument type so you can get relevant notifications – and not noise.

- Reporting is a broad term and is usually required to be cross-asset. It’s important that it can filter on asset classes and any mix of columns. Read more about Limina’s 6 different types of reporting capabilities.

Get in touch if you’d like to see Limina’s multi-asset capabilities in action or just enquire about our what we cover. If we’re not the right solution, we’re happy to consult on which systems to consider.

Considerations when selecting multi-asset software

With cross-asset software, you can see everything in one system. There are a myriad of other benefits, which we’ll cover next:

1. Level of IBOR capabilities

At the core of any system is a position & cash engine (also called “Investment Book of Records”). There are three ways for a system to produce past, current and projected position & cash views:

- Flush & fill. Positions and cash are refreshed from an accounting system or fund admin in the morning. This approach is often considered low-maintenance, but in practice it usually ends up resulting in a lot of overhead to get numbers correct (learn more in the video below).

- Rolling balance. The classic accounting principle, where today (T) is built from yesterday (T-1) plus all activities since. This approach creates one stored, “true view” of the portfolio per point in time.

- Live-extract. All activities are stored, and any portfolio view is created on demand, with a specific cash state (preliminary or confirmed), investment state (simulated, in-market, committed, etc) and point in time (past, present, future). Live-extract is Limina’s IBOR approach.

Our founder and CEO, Kristoffer Fürst, takes you through a full IBOR breakdown in the video above

2. Costs & Efficiency

With fewer systems, you almost always save costs. Due to:

- Fewer system licenses. One more extensive system might cost more than each individual system, but the net cost is almost always significantly lower

- Less integration work. Integrations cost time, at the very least, and sometimes additional license fees. With fewer systems, you have fewer integrations to worry about

Other cost considerations when choosing a system include picking a modern system (with no IT costs).

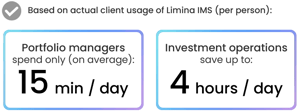

The most surprising aspect of cost is how much workflow efficiency affects the cost. We’ve seen cases where the operational savings of Limina exceeded 50% of the operations workload – saving more than the entire system fee!

We recommend choosing a provider with pricing published publicly on their website. You want to know the price before investing time with a provider, right? A provider showing you the price (online) signals they’ll be a true partner - because they put your needs before their internal concerns. Check out Limina’s pricing here.

3. A modern solution

Finally, cross-asset investment management software that users love is uncommon in this industry. Statistics on user experience are telling:

- Before starting to use Limina, end-users estimate their satisfaction will be 5/10

- Once users, the average satisfactor is a whopping 8.8/10!

4. Ease of connectivity

People think pre-built integrations are the best way to connect their systems to, e.g. service providers - but it’s not. We know a vendor with close to 1,000 out-of-the-box integrations. But investment managers still come to us for a smoother connectivity approach, because 1,000 isn’t enough. Just one single custodian can have close to 50 different connections.

The solution is a no-code integration builder, where users set up integrations in minutes. Monitoring is done via notifications and dashboards.

Limina: All asset classes in one place

Limina’s Investment Management Solution (IMS) combines the workflows you need with powerful data & automation capabilities - all in one solution, for all asset classes.