Mutual Fund Names [73k fund names analysed]

This article analyses the names of mutual funds. By looking at the naming pattern correlation to Assets under Management (AuM), it’s clear that the name of a fund does matter to attract AuM – not just performance and sales.

A mutual fund name is one of the first things an investor sees, and they will draw conclusions from the name alone. In a crowded market where products often share similar traits, a standout name can make all the difference when investors are sifting through an ocean of options.

This article builds on our previous approach of looking at investment company names. We combine data-driven insights with creative strategies, helping you develop the best fund name.

Analysis of 72,291 mutual fund names

This analysis includes 72,921 mutual funds from around the world. This sample had a cutoff of $10 million Assets under Management (AuM) (only those above included):

As you can see from the data, the average AuM is much higher than the median. This difference is because a few outliers are very large, which skews the average. Throughout this analysis, we’ll focus primarily on the median number to avoid giving too much weight to the extreme outliers.

Total AuM in the sample: 53 trillion USD, which is approximately one-third of global assets (sources of global assets vary, but likely around that order of magnitude). Exchange-traded funds aren’t included in the dataset, although from a separate analysis of ETFs, the takeaways covered here hold true for these vehicles as well.

We've used the findings from this analysis, and created a fund name generator that's free to use.

Legal notice: The data used for this analysis is gathered from a mix of publicly available online sources only - and might therefore be incorrect, incomplete or inaccurate.

Best mutual fund names

Our analysis identified 4 common naming patterns. We go through them here, and for each one, determine if there is a better or worse way to incorporate each (and when not to use a particular pattern). If you're starting a fund, please feel free to also check out Limina's Investment Management System.

- 01 Strategy

- 02 Geography

- 03 Assets

- 04 Industries

Investment approach

Mutual fund names that incorporate investment focus or investment strategy, have a significant AuM-deviation, compared to the entire set analysed. There are three distinct patterns:

- The best mutual fund names include words like “Growth”, “Value”, and “Market Cap” – indicating an investment strategy or focus. These are likelier to be large (higher average, same median).

- When “Risk” is highlighted in the name, assets are noticeably smaller (both median and average).

- Words like “Blend” and “Income” don’t deviate from the sample as a whole.

Naming strategy: Consider including the investment strategy for growth or value strategies, or if you have a market cap focus such as small-cap or mid-cap. Beyond those, it’s worth leaving this aspect out of the name.

Geographical focus

More than one-third of all mutual funds have a geographical reference in their name. To be precise, 37.4% do (27,280). There are some slight patterns, where smaller funds tend to be “Latin America” and “Asia” while larger are “Emerging”. “Europe”, “North America”, and “Global” are all close to the sample’s overall average and median.

Fund name examples in this category include First Eagle Global Fund and Fidelity European Growth Fund.

Naming strategy: There isn’t much to decide here. Just set expectations that, depending on the investment region, your portfolio can expect to be smaller or larger than the global average.

Asset classes & instrument types

Including an asset class in the fund’s name is common; 21.1% have it. Examples include “JPMorgan Equity Income Fund” and “Baird Aggregate Bond Fund”.

The most common names are Equity-related and Fixed Income-related, which isn’t surprising as the AuM of the largest 500 asset managers is allocated 48% to equities and 29% to fixed income.

Naming strategy: As with geographical regions, it doesn’t matter much for AuM if an asset class is present or not. Therefore, we suggest including it for clarity, assuming the number of words isn’t too many already (see word count analysis below).

Sector focused funds

We only found 3,401 funds (4.7%) with a sector focus highlighted in their name. The most common are real estate, health science and technology sectors. We observed no significant deviations from the sample median or average by including a sector or not.

Naming strategy: The reason to include sector or industry in the name is for investor clarity. We see no upside in attracting additional assets under management, with a sector focus or not.

Passive index funds vs active

Only 5.9% are passive funds (index tracking). The AuM differ significantly between active and passive, however:

- The median AuM is double for passive strategies compared to active

- The average AuM is 5x larger for passive strategies compared to active

- The 75th percentile is 2.5X larger for passive compared to active funds

Now, a passive strategy is a very different approach than an active strategy. Choosing one or the other isn’t a naming exercise – it’s a strategy decision for asset managers.

Since fees are usually much lower for passive funds, it’s not apparent that more net assets for such a strategy is “better”. Ultimately, generating a profit is a combination of AuM, fees and costs.

Starting a fund?

You have a million decisions to make. Choosing name is just one, and you also need to select a system.

Limina cover all your needs and scales from initial setup to global multi-asset portfolios.

Words to use in the best fund names

Let’s look at the number of words and common words, to see if we can find more patterns to identify the best mutual fund name.

Word count

The number of words varies between 1-12 (yes, as many as 12!). More than 8 is uncommon, and the most common lengths are 4-6 words. The lengths analysed here exclude words that might describe a shareclass (e.g. “A EUR”) but include the word “Fund” if used (present in 22.3% of cases).

A fund name example that we’re counted as 7 words is “Invesco Sustainable Pan European Structured Equity Fund”. Shareclasses have been ignored (e.g. “A EUR Acc”) and the AuM numbers presented in this entire article are on fund level (shareclasses aggregated).

It’s clear that word length does matter for AuM. We see the same pattern in the 25th/75th percentile and average. A short name, but not too short, is better than a long name.

Naming strategy: Aim for 3-5 words, i.e. slightly shorter than the most common mutual fund name.

Acronyms

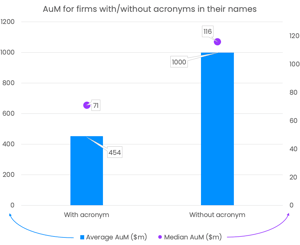

Acronyms are commonly used; we see variations of abbreviations in 1/3 of all names (not counting shareclass acronyms or currencies). Interestingly, the data on the best approach to acronyms is unambiguous: don’t use them.

The average AuM of funds without acronyms is more than double that of those with acronyms. The median is almost double.

Naming strategy: avoid abbreviations.

Common words

Looking at some of the most common words, we see some additional patterns emerge.

First of all, the conclusion from the previous section, to avoid acronyms, is strengthened:

- Funds using acronyms for Fixed Income strategies have smaller AuM than those that spell it out, e.g. “Bond”.

- The same goes for “Equity”, being better than “EQ”.

Secondly, it seems like positive words like “Income”, “Growth”, and even “Fund” are positively correlated with higher AuM. A cool fund name idea with word jackpot might be “Growth Income Fund” (only half-joking)

Cool fund names, examples & pitfall

An example of a descriptive name is “Proshares Pet Care ETF”. Granted, it’s an Exchange-traded fund (ETF) and not a mutual fund, but it’s a good example.

More examples of fund names have been provided throughout this article in the respective sections.

Starting a fund?

You have a million decisions to make. Choosing name is just one, but you also need to select a system.

Limina cover all your needs and scales,

from a simple initial setup (from $100m AuM upwards),

to global use cases with many portfolio managers, offices and portfolios ($10bn+).