Single-tenant vs Multi-tenant: A Comparison for Investment managers

Limina was started by investment managers as a reaction to problems with existing systems. We have experienced both single-tenant and multi-tenant solutions, which both come with their respective pros and cons. While Limina IMS is a single-tenant solution, it’s not the best choice for everyone. Hence, in this article we compare both options in a transparent and honest way, so that by the end you will:

- Be able to decide if multi- or single-tenant cloud solutions are the preferred option for your business, and

- If tenancy is an important consideration for your business needs.

The structure of this article is an explanation of the two alternatives from a business perspective, and then we look at the 4 most important considerations that are impacted by them. We end with a list of things that are not materially impacted by tenancy, but that we’ve seen are commonly misunderstood to be.

What is the difference between single-tenant vs multi-tenant?

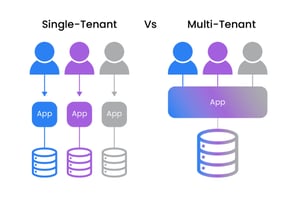

Single-/Multi-/ tenant can be understood by replacing the word “tenant” with “investment manager” or “asset manager”. We’ve illustrated examples of each below:

- “Single-tenant “ is synonymous with “single asset manager”. Here, each live environment is used by only one asset manager. Note: all users at each asset manager have access to this environment, i.e. it is unique per firm but not per user.

- “Multi-tenant” is synonymous with “multi asset manager”. In other words, multiple asset managers are sharing the same live environment. I.e. you are sharing database and system processes with other investment managers and asset managers.

A common example used to explain the two alternatives is

- Single tenancy - living in a house; and

- Multi tenancy - living in an apartment.

In an apartment, you have your own private space but are more likely to be affected by neighbours than if you lived in a house. If you have a “noisy neighbour” it is likely to affect your sleep quality.

Software hosted on-premise is always single-tenant. You would host the software yourself, for your firm’s use only.

Most Software-as-a-Service, or cloud-native software, are multi-tenant on the other hand. However, cloud-native need not be multi-tenant. Limina IMS, for example, is a cloud-native system that is also single-tenant.

Note: Oftentimes single-tenant can also be referred to as multi-instance (there are multiple instances of the system, one per asset manager). Multi-tenant is then referred to as single-instance (all asset managers run on the same system instance).

Considerations when choosing single-tenant or multi-tenant SaaS solutions

Now, let’s get into the 4 top considerations when choosing which model is right for you.

Consideration 1: data access and security

| Single-tenant | Multi-tenant |

| Database is separated between clients. Note: Sometimes this is also called portioned data |

All clients of the vendor (asset managers and investment managers) share databases |

| Security breaches could be isolated to single clients | A security breach affects all clients |

A data breach is very unlikely in both architectures (all vendors take cyber security seriously in our experience). However, if a breach should happen, it is isolated to just one client in the single-tenant architecture. If protection of your firm’s investment data is of high priority, the best option is a single-tenant solution.

Consideration 2: cost of single-tenant vs multi-tenant

It’s usually cheaper for the vendor to host a multi-tenant SaaS solution. The primary reason is that a multi-tenant solution is well-placed to share computational and storage resources between clients. At the same time, it’s more costly to develop such a solution, which balances out the cost to some degree.

The good thing is that as a client, you don’t need to care. You can just compare the subscription fees (or license and hosting combined) between vendors. This part of a cost comparison is a straightforward apples-to-apples comparison because the only hidden cost is potential hosting fees, which are usually transparent.

To read more about costs related to your investment management software, read our TCO article.

Consideration 3: system responsiveness, reliability & BCP

System responsiveness & performance

In the previous section, we mentioned that efficient resource-sharing can drive costs down for multi-tenant technology. This sharing of resources means a less responsive system that doesn't measure at par performance-wise.

Reliability

If a buy-side multi-tenant system goes down, it goes down for all asset managers and investment managers that use the solution. A less extreme scenario is if one asset manager processes a lot of orders – then the system becomes slower for you as well.

Business Continuity Plan (BCP)

With a separate database in the single-tenant model, it’s easier to restore when executing a business continuity plan. It's also easier to trace down causes of problems since audit logs are for your environment only and not mixed with audits of other clients.

Consideration #4: change management & customisation

With all clients separated (single-tenant SaaS), clients can be on different versions. This is one example of a higher level of customisation that becomes possible. The benefit comes to you through configuration, which means it doesn’t drive additional cost. This contrasts with traditional customisation – such as for on-premises or hosted solutions - that rely on expensive custom code which is a cost that ends up in your lap.

We often think about customisation vs one-size-fits-all like a scale, with the sweet spot for most asset managers with $1-100bn Assets-under-Management somewhere between the two extremes (fully custom and not at all customised). This is illustrated below:

Finally, in a multi-tenant solution, you have less control of the environment. The vendor might have to make changes or upgrade the environment at a time that doesn’t suit you.

What is NOT affected by tenancy

Below is a list of things that, in our experience, are not affected by tenancy. These are very important considerations still, but not relevant in terms of tenancy specifically.

- Implementation.

There are sometimes claims made that it’s easier to implement a single-tenant solution (like Limina IMS). In our experience, the difference is minimal in practice and there are many other more important aspects to consider for the implementation. - Efficiency of processing resources.

While true that multi-tenant solutions are generally more resource-efficient, the effect of this is fully captured under costs if you’re buying a cloud solution. - Hidden costs.

There are no differences in hidden costs between the two options. - Quick access.

While usually faster for a new client to get access to the system in a multi-tenant solution, the difference is usually measured in hours which is not significant in terms of the timeline for implementation and procurement of an Investment Management System.

Concluding the single-instance vs multi-instance comparison

It's our hope that you now have a much better view of why and when the difference between single- vs. multi-tenant matters. It’s our view that there is no obvious best option for all asset managers, it rather depends on your portfolio management and order management needs. Most of the time the key trade-off is data privacy (ensured in single-tenancy) vs cost (lower in multi-tenancy).

In the below video, our CTO Andreas Fürst discusses the challenges of one-size-fits-all SaaS and why we set out to create an enterprise cloud-native solution (spoiler: the enterprise solution doesn’t magically solve all problems)

Limina has chosen a single-instance architecture because we believe the primary downside (cost) can be managed by us – i.e. it doesn’t need to affect you as a client. If you would like to see and compare the cost for yourself, please contact us to get a free quote for Limina Investment, Portfolio and Order Management System, please contact us.

Our organisation is required to support some bespoke compliance rules, which we understood were not going to be available ‘out the box’. This was a key consideration in our choice of partner, and we worked closely with Limina and our business users to design appropriate solutions, which are now used on a daily basis, helping to streamline our processes and optimally manage our risk.

- Business Analyst, $11bn Asset Owner