Portfolio & Asset Allocation Software [institutional]

Institutional asset allocation software

In this article, we focus on asset allocation software for institutional investors. We cover not just functionality, but what needs to be in place before features are relevant (data foundations). We go beyond simple asset class allocation and cover what a system must have to empower strategic portfolio allocation. Let’s get into it!

PS. Limina is an investment management system, that covers workflows from allocation all the way to operations. You can find product resources in the menu if you’d like to learn more. We also have transparent articles about when we’re a great fit and when we’re not the best choice.

Pre-requisites for the best asset allocation software

When you browse online or watch demos of portfolio allocation software, it’s easy to get drawn into a feature comparison. However, features matter less than:

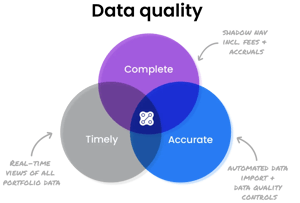

- Getting the data right.

Features are useless if based on incomplete, inaccurate or lagging portfolio data - because they operate on the wrong portfolio. Unfortunately, this is the reality for most allocation software. Look-through is included as a requirement here, for those of you that invest in PE/VC funds - Modelling the same portfolio under different assumptions at once.

With the flick of a button, being able to:

A. Show a portfolio with hypothetical changes, with fees and cash adjusted.

B. Show the same portfolio with those same changes, without in-flight transactions (assuming we cancel what is in-market).

Let’s look closer:

More than one view of the portfolio

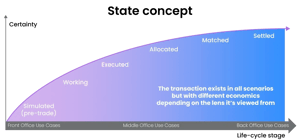

Many investment allocation softwares give only two views of your portfolio: the “current” portfolio and a “simulated” portfolio that includes any allocation changes you’re simulating.

The problem with this approach, is that there is no correct “current” view of your portfolio. Is it the settled cash and transactions? Or does it include those that have been successfully executed but not yet settled? What about those in-market but not yet executed? A software provider shouldn’t decide what you want to see.

Instead, a system shall give you as a user, the ability to change what portfolio you want to see at any given time – with a simple button click. Only with this granularity to what you’re looking at, can your team make the most informed decisions possible. Check out Limina’s platform if you’d like to see how it works in practice.

Overcoming the pain of getting data into the system

Existing providers rely on managed integrations to get data into the system from general partners, custodians, benchmarks, etc. Each integration is coded and maintained by the vendor. The downsides with this approach are:

- It takes weeks or months to add a new data source (e.g. a new GP)

- It costs you money, e.g. pay per report to the vendor

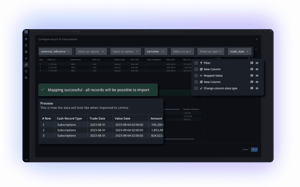

There is a new way to make the process of data aggregation faster and cheaper: a user-configurable import application. The benefits are:

- You’re not dependent on us as a vendor to have an integration built

- Build new imports for anything (holdings, capital calls, cash, etc) in minutes

- Get warnings on data issues or delays

Limina is a pioneer and, to our knowledge, the only software for asset allocation with a built-in user-configurable data import/export application – and it’s free of charge!

You can use it standalone without our platform. Additionally, the application also functions as a reporting software, i.e. it can export data from the system. Please contact us to get free access.

Look-through, benchmarks & exposures

All asset allocation systems visualise your portfolio exposures by asset class. Some enable you to slice and aggregate exposures on any other parameter you want, such as sector, region, etc. Flexible aggregation allows you to compare your allocation against benchmarks, even on a sub-section of your portfolio (e.g. “compare our 20% listed equities geographical exposure to index A”).

To enable slicing on any parameter (not just asset classes), the best asset allocation software naturally includes look-through capabilities (both for fund-of-funds and index derivatives). There are two ways look-through is possible: on constituent and proxy levels (e.g. “20% industrials”). Some systems support both (such as Limina).

Investment allocation calculator, simulator & decision-support tool

Only now is it time to consider additional features and also what features aren’t necessary. There are two capabilities often bolstered by providers that, in reality, we find aren’t particularly useful in practice:

- Investment allocation calculator.

Tools that can calculate an allocation from given investment objective inputs. These tools are almost inevitably too simplistic to be useful for institutional asset allocators, and are more applicable for financial advisors. - Asset allocation optimisation software.

An asset optimiser creates investment allocations based on boundary conditions. It works reasonably well for single asset classes, but it struggles with fund-of-funds where there are complex exposure limitations due to being unable to control holdings directly.

Valuable features of an investment allocation tool

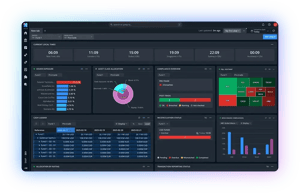

1. Visualisations

Graphs and charts are fast ways to get a holistic view of your portfolios. It can be a wide range of visualisations, for example, of your current or simulated exposures and level of risk, grouped in any way you want.

2. Plan future transactions

If your team is working on implementing a previous investment strategy change, you need to see those work-in-progress transactions when doing a new reallocation. Depending on asset classes (e.g. alternative investments), redemptions can be planned weeks or months into the future. You must have visibility on these changes and understand how far your team has come in implementing them.

At Limina, we call this functionality “order planner” or “portfolio ladder”. To our knowledge, Limina is the only asset allocation modelling software with this capability.

3. Performance reporting of past allocation decisions

A way to evaluate investment performance is to use performance attribution software. For example, Limina’s Brinson-Fachler model helps you see your performance due to allocation vs selection, so you isolate the risk and return from market conditions, selection and allocation.

Explore a better asset allocation system

See how Limina can help you increase workflow efficiency and get full visibility of portfolios.

Glossary

You have probably noticed we’ve used “portfolio” and “asset” interchangeably in this article. Portfolio takes a top-down perspective, meaning how you allocate your portfolio. Assets take a bottoms-up perspective, asking what assets you allocate to. In practice, it’s the same thing said in two different ways.

“Investment allocation tool” is considered the same as “asset allocation X”.

We’ve also used the terms “software”, “tool”, and “system” interchangeably to make reading more natural (in place of the X).

An asset allocation strategy means a deliberate approach to allocating over time, which is usually a fundamental component of a long-term investment strategy. Software can’t be “strategic”, so there is no such thing as “strategic asset allocation software”. The software can just support a strategic approach, making it easier to implement and evaluate it.

If you’re not a financial professional, you might look for software to help you manage the risk of your portfolio and reach your investment goals. This article doesn’t cover these kind of tools.